-

Sustainability at Fujitsu Group

- Sustainability Management in the Fujitsu Group

- GRB(Global Responsible Business)Goals and Achievments for FY2022

- GRB(Global Responsible Business)Goals for FY2025

- Fujitsu's accessibility

- Stakeholder Engagement

- United Nations Global Compact

- SDG-related Activities in Fujitsu

- External Recognition and Awards

-

Global Responsible Business

- Environment

-

- Environmental Management

- The Fujitsu Group Environmental Vision on Climate Change

- Living in Harmony with Nature (Conservation of Biodiversity)

- Environmental Action Plan

- Environmental Data

- Environmental Communication

- Environmental Social Activities

- Disposal and Recycling of ICT products

- Environmental Considerations in ICT Products

- Governance

-

Data and Documents

- Fujitsu Group Sustainability Data Book 2024

- Social, Governance and Environmental data

- Independent Assurance Report

- GRI Standards / United Nations Global Compact (UNGC) principles Comparison Table

- SASB Standards Comparison Table

- Sustainability Information Disclosure Framework

- Link to regions responsible business reports

- Contact

- Sitemap

TCFD-Based Information Disclosure

The Task Force on Climate-Related Financial Disclosures (TCFD) was established by the Financial Stability Board at the request of the G20 with the objective of reducing the risk of instability in financial markets due to climate change. The task force announced its recommendations in June 2017, asking companies and organizations to identify and disclose the risks and opportunities arising from climate change. The Fujitsu Group announced its support for the TCFD recommendations in April 2019 and is making every effort to disclose information in line with those recommendations to investors and other stakeholders. Disclosures are provided via media such as financial statements, CDP (*1) questionnaires, the Integrated Report, and websites.

- (*1)CDP: An international nonprofit organization that conducts environmental surveys of more than 24,800 companies worldwide and acts on behalf of institutional investors with a combined US$140 trillion in assets. (As of January 2025)

| Item | Response status | Reference | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Governance | Oversight structure under the Board of Directors for climate-related risks and opportunities |

| ||||||||||||||||||||||

| Role of management in assessing and managing climate-related risks and opportunities |

| |||||||||||||||||||||||

| Strategy | Short-, medium- to long-term climate-related risks and opportunities |

Note: See the CDP responses (C 2.3, 2.4) | ||||||||||||||||||||||

| Impacts on business, strategy, and financial planning | ||||||||||||||||||||||||

| Resilience of the organization's strategy, taking into consideration different climate-related scenarios, including a 2℃ or lower scenario |

| |||||||||||||||||||||||

| Risk Management | Climate-related risk identification and assessment process |

| ||||||||||||||||||||||

| Climate-related risk management process |

| |||||||||||||||||||||||

| Status of integration with organization-wide risk management |

| |||||||||||||||||||||||

| Metrics and Targets | Metrics used by the organization to assess climate-related risks and opportunities in line with its strategy and risk management process |

| ||||||||||||||||||||||

| GHG emissions for Scope 1, 2, and 3 | GHG emissions

| |||||||||||||||||||||||

| Targets used by the organization to manage climate-related risks and opportunities and performance against targets | Climate-related targets and performance

| |||||||||||||||||||||||

Governance

The Fujitsu Group has established a Sustainability Management Committee, chaired by the CEO. This committee examines medium- to long-term issues, formulates policy, shares the business risks and opportunities of climate change and decides how to address those risks and opportunities, and manages the company’s progress. It also reports on the results of its activities to the Board of Directors at meetings of the Executive Management Council. In October 2020, the committee made a key decision by revising the Fujitsu Group GHG reduction target (SBT) from 2.0°C to 1.5°C. In April 2021, the new target was validated as 1.5°C-aligned to the SBTi. In October 2021, the results of scenario analyses using two external scenarios, one for 1.5°C and the other for 4°C, were reported to the Sustainability Management Committee. The findings prompted lively discussion among the committee members on topics such as the need to discuss management strategies, the selection of key solutions, and the measurement of impacts once solutions are provided.

Within the company-wide risk management regime and with oversight by the Board of Directors, the Risk Management & Compliance Committee, chaired by the CEO, conducts risk analysis and implements responses for the entire Group, including on issues relating to climate change. This committee is also the ultimate decision-making body for risk management and reports regularly to the Board of Directors regarding major risks that have been identified, analyzed, and assessed. The Fujitsu Group has also developed environmental management systems (EMS) based on the ISO 14001 standard, and the results of EMS activities are reported to the Board of Directors at meetings of the Executive Management Council.

To further strengthen governance relating to climate change, in April 2022 we added ESG-related third-party evaluations (DJSI(*2)) and CDP climate change program(*3) as assessment indices for the bonuses paid to Executive Directors. As of FY2022, these indices will apply to their bonuses. (Executive compensation consists of base compensation, bonuses, and performance-linked stock compensation.).

- (*2)Dow Jones Sustainability Index (DJSI): This is a share index published by S&P Dow Jones of the United States that analyzes companies with respect to their corporate economic, environmental, and social performance, and selects companies with superior corporate sustainability.

- (*3)CDP climate change program: A program run by CDP to survey and assess corporate climate change initiatives and publish the results of those surveys.

Strategy

Climate Change Risks and Opportunities

We have identified the risks and opportunities of climate change for the Fujitsu Group, and considered our responses, by analyzing the business impacts of climate change using external scenarios for 2℃ of global warming in FY2018, and for warming of 1.5℃ and 4℃ in FY2021.Our aim is to address the transitional and physical risks that negatively impact Fujitsu operations and supply chains, and to identify the climate-related risks faced by customers so that we can better make proposals that create value and grasp the business opportunities on offer.

Risks

| Risk type | Term | Details | Key responses | |

|---|---|---|---|---|

| Transition | Policy/Regulation | Short- to long-term |

|

|

| Market | Medium- to long-term |

|

| |

| Technology | Medium- to long-term |

|

| |

| Reputation | Short- to long-term |

|

| |

| Physical (Natural disasters etc.) | Chronic/Acute | Short- to long-term |

|

|

Financial impact of various risks * Estimates as at FY2024

| Risk type | Example of risk | Details | Term | Financial impact (JPY) | Details of financial impact |

|---|---|---|---|---|---|

| Transition | Policy

carbon pricing mechanism |

| Medium- term | Min.: 1,454,175,300

~ Max.: 15,268,840,650 |

|

| Transition | Policy

increased expenditure related to fluctuations in electricity rates and decarbonization levies |

| Medium-term | 3,900,000,000 |

|

| Transition | Reputation

increased concern among partners and stakeholders, and negative feedback |

| Short-term | Min.: 14,200,000,000

~ Max.: 28,500,000,000 |

|

- (*4)IEA: An abbreviation for the International Energy Agency. An international energy organization that provides guidance on global energy policy, and conducts energy market analysis and the collection and publication of energy statistics.

- (*5)FIT surcharge: Abbreviation of Renewable energy power generation promotion Feed-In-Tariff levy. The partial bearing of electricity charges based on the renewable energy fixed price acquisition system (FIT system)

Opportunities

| Opportunity type | Term | Details | Key responses |

|---|---|---|---|

| Products/services | Short- to long-term |

|

|

| Market | Short- to long-term |

|

|

| Resilience | Short- to long-term |

|

|

Scenario Analysis

Premise

In FY2021, the Fujitsu Group conducted scenario analyses out to 2050 using scenarios for 1.5℃ and 4℃ of global warming. The analyses studied businesses likely to be impacted by climate change in the following areas: Sustainable Manufacturing (sectors studied: petrochemicals, automotive, foods, electronic device-related businesses), Trusted Society (sectors studied: public sector, transportation, energy-related businesses), and Hybrid IT (sector studied: datacenter-related businesses).

| Scenario selection |

|

|---|---|

| Target businesses | Opportunity-focused analysis: Addressing climate-related risk in client industries

|

| Period covered |

|

Analysis Steps and Details

The analysis was conducted in 4 steps: assessment of risk severity, definition of scenarios, evaluation of impacts on business, and discussion of countermeasures.

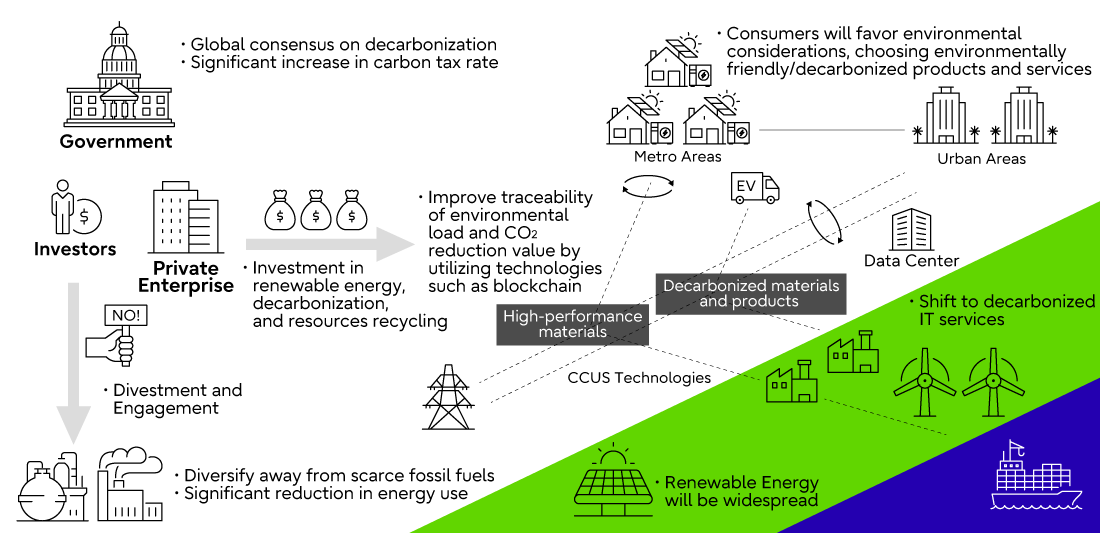

We began by organizing the risks and opportunities for the target businesses based on data such as the TCFD recommendations and external reports. We also conducted workshops to look at the qualitative aspects of business impacts stemming from each risk and opportunity item from the perspectives of Fujitsu and industry generally. We rated the severity of each risk or opportunity as “High”, “Medium” or “Low”. We then considered the future changes in each of the items classified as having a “High” severity and defined our scenarios using data from agencies such as the IPCC, IEA, and the Ministry of the Environment, together with the evidence provided in various reports. Specifically, we held an executive input session to consider global outlooks for 2050 given temperature rises of 1.5°C and 4°C, and then went on to consider the global outlook for each of the target industries, using tools such as Five Forces analysis. (See below for the 1.5°C global outlook.)

Global outlook of a 1.5°C “carbon-neutral world in 2050”

Global outlook of a 1.5°C “carbon-neutral world in 2050”

To look at the impacts on business, we then tentatively calculated the qualitative gap between the scenarios and our existing strategies and plans with respect to risks and opportunities. For Hybrid IT (sector studied: datacenter-related businesses), we discussed how the impacts of climate change on business would affect our Profit and Loss Statement, specifically looking at which financial indicators would be impacted and in what ways. We then summarized those impacts by developing calculation logic for each impact. Both internal and external data and information were used to confirm the positive (opportunities) and negative (risks) impacts on operating profit in 2050. For example, the calculations for the 1.5℃ scenario showed rising costs due to changes in power prices, but also revealed that there will be increased demand for carbon-neutral datacenters and for datacenters generally due to increased communications traffic as the uptake of smart devices accelerates. Overall, the calculations showed that the negative financial impacts of risks will be outweighed by the positive financial benefits arising from opportunities, ultimately leading to a net positive financial impact on operating profits.

Our analysis of Sustainable Manufacturing (sectors studied: petrochemicals, automotive, foods, electronic device-related businesses) and Trusted Society (sectors studied: public sector, transportation, energy-related businesses) focused on the business opportunities arising from climate change, assuming the potential to establish new climate change-related markets and concluding that the net impact on sales in 2050 would be positive.

Finally, we held a workshop in which we organized the trends in each industry that had been identified when defining the scenarios and the direction of measures to deal with the business impacts requiring emphasis. In specific terms, during the group work we reviewed the current initiatives and gathered views on the directions that future initiatives should take, taking into account the expectations on Fujitsu in the medium- to long-term.

Analysis Results

Because we were able to confirm that the study and development directions for our business unit offerings are aligned with the opportunities shown in the scenario analyses, and that countermeasures for the identified risks are also being prepared, our assessment was that Fujitsu’s businesses are strategically resilient from a medium- to long-term perspective.

Our current themes and areas are “Carbon Neutrality” and “Resilient Supply Chains” in the Sustainable Manufacturing area, and “Sustainable Energy & Environment” and “Sustainable Transportation” in the Trusted Society area, and we are progressing with the development of our offerings.

<Opportunity Analysis>

Target businesses : Sustainable Manufacturing

| Sectors studied | Risk severity assessment

(both 1.5℃ and 4℃) | Scenario definitions | Countermeasure considerations (in part) |

|---|---|---|---|

| Petrochemical businesses | <Policy/regulation, markets, technology, reputation>

Proliferation of ICT in recycling-based business platforms in the shift to carbon-neutrality

<Natural disasters>

| 1.5℃ scenario | |

| Switch to environmentally friendly products that use carbon-neutral materials throughout the supply chain, increasing portfolio reform, increased demand for greater traceability and more efficient R&D |

| ||

| 4℃ scenario | |||

| Increased demand for resilient factories and supply chains due to increasingly severe natural disasters |

| ||

| Automotive businesses | <Policy/regulation, markets, technology, reputation>

Stronger regulation of internal combustion engines; widespread adoption of electric vehicles, move toward carbon-neutrality in the entire product life cycle

<Natural disasters>

| 1.5℃ scenario | |

| Increased demand for services such as MaaS and greater supply chain traceability to help reduce environmental impacts through the entire life cycle |

| ||

| 4℃ scenario | |||

| Faster rollout of internal combustion engines, increased demand for advanced technology. Also, increased demand for enhanced business continuity and stability in raw materials procurement in the face of more severe natural disasters |

| ||

| Food-related businesses | <Policy/regulation, markets, technology, reputation>

Increased awareness of ethical consumption, promotion of resource recycling and biodiversity, etc.

<Natural disasters>

| 1.5℃ scenario | |

| Changed consumer awareness leading to increased demand for measures to deal with food waste and support for smart agriculture, certificates of origin, and environmentally friendly packaging materials |

| ||

| 4℃ scenario | |||

| Increased demand for "resilient agriculture" to cope with issues of stable food supply resulting from natural disasters |

| ||

| Electronic device-related businesses | <Policy/regulation, markets, technology, reputation>

Energy savings in factories and growth in the market for products for EVs; potential for fundamental manufacturing reforms, such as 3D printers and the "buy local" movement

<Natural disasters>

| 1.5℃ scenario | |

| Proliferation of energy/labor-saving technologies. Increased demand from radical changes to business models (demand chains, etc.) |

| ||

| 4℃ scenario | |||

| Increased demand for higher labor productivity in production sites and the construction of factories and supply chains capable of handling the risks posed by natural disasters |

| ||

Target businesses : Trusted Society

| Sectors studied | Risk severity assessment

(both 1.5℃ and 4℃) | Scenario definitions | Countermeasure considerations (in part) |

|---|---|---|---|

| Public sector, transportation, energy-related businesses | <Policy/regulation, markets, technology, reputation>

The values by which we select cities and services, such as environmental concerns, will changes as we shift to carbon neutrality

<Natural disasters>

| 1.5℃ scenario | |

| Increased demand for quantifying and visualizing new values, such as environmental concerns, and the digitalization of urban and energy infrastructure |

| ||

| 4℃ scenario | |||

| Increased demand for resilient urban infrastructure |

| ||

<Risk & Opportunity Analysis>

Target businesses : Hybrid IT

| Sectors studied | Risk severity assessment

(both 1.5℃ and 4℃) | Scenario definitions | Countermeasure considerations (in part) |

|---|---|---|---|

| Datacenter-related businesses | <Policy/regulation, markets, technology, reputation>

Traceability of environmental values, datacenter electrification, and the adoption of smart technology will all progress

<Natural disasters>

| 1.5℃ scenario | |

| Energy savings and environmental concerns become the standard for service selection by customers, and carbon neutrality in datacenters themselves becomes a source of competitive strength |

| ||

| 4℃ scenario | |||

| Increased demand for resilient datacenters. Disaster risk for Fujitsu-owned datacenters is also increasing and countermeasures are needed |

| ||

*The above scenario analyses are intended to verify the strategic resilience of Fujitsu businesses based on an assumed hypothesis and are positioned as one simulation that takes into account future uncertainties.

Risk Management

As part of our company-wide risk management system, we have established the Risk Management and Compliance Committee to identify, assess and manage risks across the entire Fujitsu Group, including those related to climate change. To conduct company-wide risk assessments on a regular basis, the committee prepares tools, distributes them to each Risk Management & Compliance Officer and gathers responses. The departments in charge of each risk across the company utilize these tools to conduct assessments on items such as the impact and likelihood of occurrence related to risk threats and the status of countermeasures, and they also provide responses regarding those risk threats. Climate change-related risk assessments are conducted by all relevant departments, using information collected from across the company, based on the expertise of each department in areas such as policy, reputation, natural disasters, the supply chain, and products and services. The Risk Management and Compliance Committee conducts an integrated matrix analysis of the assessments returned by each department with respect to impact severity and likelihood, and then identifies high-priority risks at the company-wide level. The results of this analysis are reported to the Board of Directors.

The Sustainable Management Committee shares the business risks, opportunities, and countermeasures resulting from climate change, and manages their progress. The Fujitsu Group has also established environmental management systems based on the ISO 14001 standard. Under these systems, we monitor regulatory compliance and other risks.

Metrics and Targets

In 2017, the Fujitsu Group obtained 2°C-aligned certification from the SBTi for its GHG emissions reduction targets, and in 2021 we were granted 1.5°C-aligned certification for our revised targets. To accelerate our efforts towards carbon-neutrality, we set new targets to achieve net-zero emissions from our business activities by FY2030 and net-zero emissions through our entire value chain by FY2040 and were granted net-zero certification by the SBTi. In line with the SBT updates, we have also revised our RE100 renewable energy target, bringing our target of 100% renewables by 2050 forward by 20 years and aiming to achieve 100% renewable energy by FY2030.

Against our target of 100% Scope 1 and 2 GHG reductions in our own emissions by FY2030, in the current year we achieved a reduction for FY2023 of 41.6% on FY2020 levels. Against our target of a 90% reduction (on FY2020 levels) in GHG emissions throughout the value chain (scope 1, 2 and 3 emissions) by FY2040, we also achieved a 28.1% reduction in FY2023.

We boosted our use of renewable energy up to 42.7% in FY2023 towards our target of 100% renewable energy use by FY2030.