-

Sustainability at Fujitsu Group

- Sustainability Management in the Fujitsu Group

- GRB(Global Responsible Business)Goals for FY2025

- GRB(Global Responsible Business)Goals and Achievments for FY2022

- Fujitsu's accessibility

- Stakeholder Engagement

- United Nations Global Compact

- SDG-related Activities in Fujitsu

- External Recognition and Awards

-

Global Responsible Business

- Environment

-

- Environmental Management

- The Fujitsu Group Environmental Vision on Climate Change

- Living in Harmony with Nature (Conservation of Biodiversity)

- Environmental Action Plan

- Environmental Data

- Environmental Communication

- Environmental Social Activities

- Disposal and Recycling of ICT products

- Environmental Considerations in ICT Products

- Governance

-

Data and Documents

- Fujitsu Group Sustainability Data Book 2024

- Social, Governance and Environmental data

- Independent Assurance Report

- GRI Standards / United Nations Global Compact (UNGC) principles Comparison Table

- SASB Standards Comparison Table

- Sustainability Information Disclosure Framework

- Link to regions responsible business reports

- Contact

- Sitemap

Corporate Governance

Basic Approach to Corporate Governance

Through a decision by the Board of Directors in December 2015, Fujitsu formulated a basic policy that sets out its approach to corporate governance (the "Corporate Governance Policy"). We updated the policy in September 2023 and, adopting the stance that the aim of corporate governance is to ensure better management, we constantly review the policy to ensure that it does not become rigid or lose its relevance. We also discuss it with the Board of Directors as appropriate, and strive to maintain the best corporate governance system at all times.

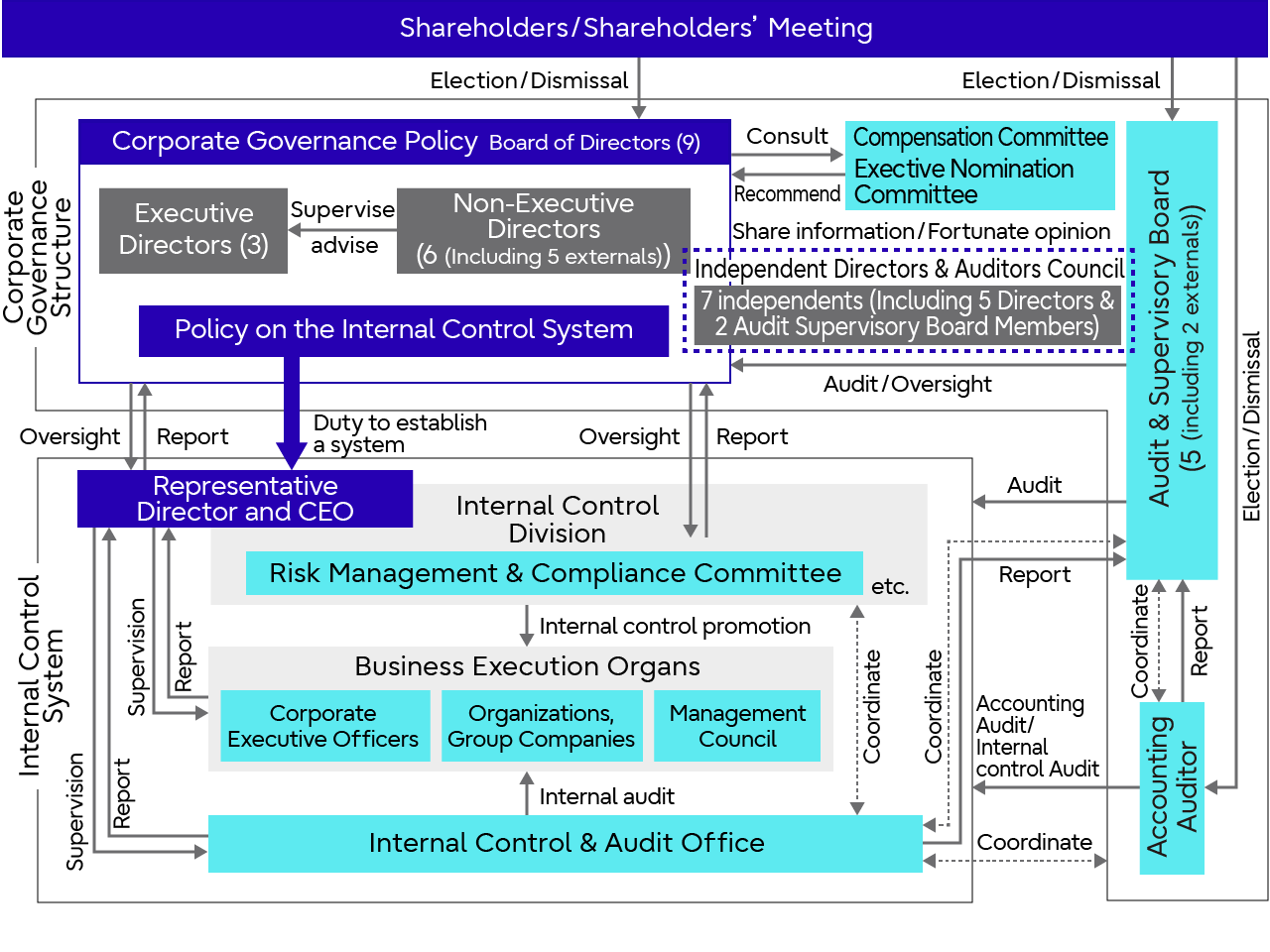

Corporate Governance Structure (as of June 24, 2024)

In accordance with its Corporate Governance Policy, the company outlines the following rules to ensure effective oversight and advice, given from the diverse perspectives of Non-Executive Directors (hereinafter, the term used for a combination of Independent Directors and Non-Executive Directors appointed from within the company), to Executive Directors on their business execution as part of the Board of Directors function while taking advantage of the company through the Audit & Supervisory Board system.

<Board of Directors>

The Company has a Board of Directors to serve as a body for making important decisions and overseeing management. The Board of Directors delegates the decision-making authority over business execution to the Representative Directors and subordinate Corporate Executive Officers to the broadest extent that is permitted by law and the Articles of Incorporation of the company and is considered to be reasonable and will mainly perform as oversight and advisory function. Moreover, the Board of Directors has been formed with Non-Executive Directors at its core so as to enable correction and remediation of errors, insufficiencies, and recklessness in business execution. And by ensuring that External Directors, who are highly independent and hold diverse perspectives, constitute the majority of the members of the Board of Directors, the oversight and advisory function of the Board of Directors is strengthened. Furthermore, in order to better define the management responsibility of the Directors, their terms were reduced from two years to one year in accordance with a resolution at the June 23, 2006 Annual Shareholders’ Meeting.

As of June 24, 2024, the Board of Directors consists of nine members in total, comprising three Executive Directors and six Non-Executive Directors (including five External Directors).

In FY2023, the Company held 18 Board of Directors meetings (including six extraordinary meetings) to flexibly resolve and report on the matters that come under the Board’s province pursuant to the Companies Act and the Regulations of the Board of Directors of the Company. The Board identified the following six themes as the themes that it should focus on based on the business environment surrounding Fujitsu Group: 1) new medium term management plan; 2) business portfolio transformation; 3) profitability improvement in international business; 4) quality and security issues; 5) succession planning of Directors and others; and 6) efficient monitoring methods of these themes. The Board had intensive discussions on these themes and continued monitoring them.

Furthermore, as its agenda items, the Board discussed and heard reports on shareholder returns, examinations of strategic shareholdings, the organization and operation status of internal control systems, and feedback on dialogues with shareholders and investors. For the evaluation of the effectiveness of the overall Board, the Board’s Secretariat introduced individual interviews based on questionnaire responses from FY2023 and analyzed and evaluated the interviews. This allowed the Board to discuss accurate improvement measures based on the correct understanding of responses and led to efforts to improve information sharing with outside officers and to further raise the effectiveness of the Board. The Risk Management & Compliance Committee that oversees risk management of the entire Group began holding a monthly meeting from FY2023 to ensure the speediness and effectiveness of each measure. The Board of Directors received a report on the implementation status of the Committee’s tasks at ever y Board meeting and discussed and monitored actions taken, including preventative actions of individual quality and security issues.

<Audit & Supervisory Board>

The Company has an Audit & Supervisory Board that performs the auditing and oversight functions. The auditing and oversight functions are carried out by Audit & Supervisory Board Members, who review the Board of Directors as well as business execution functions and attend important meetings, including meetings of the Board of Directors. As of June 24, 2024, the Audit & Supervisory Board has five members, comprising two full-time Audit & Supervisory Board Members and three External Audit & Supervisory Board Members.

In FY2023, the Company held 11 Audit & Supervisory Board meetings (including two extraordinary meetings), mainly to develop and resolve its audit policy and audit plans, confirm the audit plan and method of Accounting Auditors, and examine the appropriateness of their audit results and key audit matters. In addition, the Audit & Supervisory Board heard reports from the internal audit section and heard and discussed the reports on important items made by full time Audit & Supervisory Board Members to Externa l Audit & Supervisory Board Members. Except for one meeting where one member was absent, all Audit & Supervisory Board Members attended all Audit & Supervisory Board meetings.

In FY2023, Audit & Supervisory Board Members conducted the following activities with a focus on the building and operation of internal control systems and responses to management challenges in accordance with the approved audit policy and plans:

- Attending and expressing opinions at the Board of Directors meetings, meetings of Independent Officers, and other important meetings

- Reading important approval documents

- Exchanging opinions with Representative Directors

- Interviewing each business line at the Head Office and subsidiaries on their operations

- Hearing reports from statutory auditors of subsidiaries

- Hearing reports from Accounting Auditors

- Hearing the audit status and results from the internal audit section

- Hearing the status of whistleblowing from the compliance section

- Hearing the status of risk management and quality control

The discussion topics were potential risks of material misstatements in the consolidated financial statements and impacts of, and developments in, material events, etc. that occurred in FY2023

<Independent Directors & Auditors Council>

In response to the requirements of Japan’s Corporate Governance Code, which facilitates the activities of Independent Directors and Auditors, and in order to invigorate discussions on the medium- to long-term direction of the Company at its Board of Directors Meetings, the Company believes it essential to establish a system that enables Independent Directors and Auditors, who maintain a certain degree of separation from the execution of business activities, to consistently gain a deeper understanding of the Company’s business. Based on this recognition, the Company established the Independent Directors and Auditors Council, which consists of all Independent Directors and Auditors (five Independent Directors and three Independent Auditors), and discusses the medium- to long-term direction of the Company, shares information, and exchanges viewpoints so that each can formulate their own opinions.

In FY2023, the Company held 8 Independent Directors and Auditors Council meetings. The members continuously discussed the Company’s management direction and on important management matters that were associated with business restructuring including mergers and acquisitions by the Company and the Fujitsu Group, and shared information and exchanged viewpoints.

<Executive Nomination Committee & Compensation Committee>

The Company has established the Executive Nomination Committee and the Compensation Committee as advisory bodies for its Board of Directors for the process of nominating Directors and Audit & Supervisory Board Members, for ensuring the transparency and objectivity of its process for determining executive compensation, to enable efficient and substantial discussions, as well as to ensure the fairness in the structure and level of executive compensation.

The Executive Nomination Committee deliberates on the candidates for Director and Audit & Supervisory Board Member positions in accordance with the Framework of Corporate Governance Structure and the Procedures and Policy for the nomination and dismissal of Directors and Auditors stipulated in the Policy, and it provides its recommendations or proposal to the Board of Directors. In addition, the Compensation Committee provides its recommendations or proposal on the level of base compensation and the method for calculating performance-based compensation to the Board of Directors in accordance with the Procedures and Policy of Determining Directors and Auditors Compensation, as stipulated in the Policy.

The Executive Nomination Committee consists of three Non-Executive Directors (including two Independent Directors) and the Compensation Committee consists of three Independent Directors. The members appointed to the two committees in June, 2024 are as follows. Additionally, the secretariats of both committees are operated by the Company’s HR and legal departments.

- Executive Nomination Committee

Chairperson: Chiaki Mukai (Independent Director)

Members: Yoshiko Kojo (Independent Director), Hidenori Furuta (Non-Executive Chairman, Board of Directors) - Compensation Committee

Chairperson: Byron Gill (Independent Director)

Members: Kenichiro Sasae (Independent Director), Takuya Hirano (Independent Director)

In FY2023, the Executive Nomination Committee met nine times and the Compensation Committee met seven times. The Executive Nomination Committee considered a proposal for the election of Representative Directors, including the CEO, and proposals for the election of candidates for Directors, Audit & Supervisory Board Members, and the Chairman of the Board of Directors, etc. The Compensation Committee discussed the revision to the level of compensation of Directors, revision to the performance related compensation for the Executive Directors and the introduction of share based compensation for the Non-Executive Directors.

And each Committee provided its findings to the Board of Directors by the end of the period under review.

The Executive Nomination Committee also considered the succession plan for the CEO, etc. and the selection of candidates for External Directors and Audit & Supervisory Board Members, and conducted a peer review of Non-Executive Directors, while the Compensation Committee discussed the amount of compensation paid to each Executive Director for the period under review.

The diagram below illustrates the Company's corporate governance structure.(As of June 24, 2024).

Corporate Governance Structure

Corporate Governance Structure

*Number inside parenthesis refers to number of Directors and /or Audit & Supervisory Board Members

Reasons for Adoption of Current Corporate Governance System

We believe that both direct oversight to business execution by the Non-Executive Directors and the oversight by Audit & Supervisory Board Members that stays distant from the decision making and operation of business execution should work jointly to ensure highly effective oversight performance. The company adopts “the company with Audit & Supervisory Board system” that establishes the Audit & Supervisory Board, which is composed of the Audit & Supervisory Board Members appointed as an independent agent.

Moreover, the Board of Directors has been formed with Non-Executive Directors at its core so as to enable correction and remediation of errors, insufficiencies, and recklessness in business execution. And External Directors constitute the majority of the members of the Board of Directors. The core of Non-Executive Directors shall be External Directors with a high degree of independence and diverse perspectives. Moreover, at least one Non-Executive Director is appointed from within the Company to complement the External Directors’ knowledge in the business fields and the culture of the Company, so that the efficiency of oversight and advice performance by the Non-Executive Directors is enhanced.

Policy for Determining Executive Compensation

The compensation of Directors and Auditors is determined based on the "Basic Policy on Executive Compensation," which sets out the details of individual compensation for Directors, and was decided by the Board of Directors in response to a recommendation from the Compensation Committee.

Basic Approach to the Internal Control System

To continuously increase the corporate value of the Fujitsu Group, it is necessary to pursue management efficiency and control risks arising from business activities. Recognizing this, the Board of Directors have formulated the "Policy on the Internal Control System", which provides guidelines on: a) how to practice and promote the Fujitsu Way, the principles that underlie the Fujitsu Group’s conduct; and b) what systems and rules are used to pursue management efficiency and control the risks arising from the Company’s business activities.

See below for the full text of the Policy on the Internal Control System and an overview of the operating status of the systems tasked with ensuring appropriate business practices.

Disclosures Relating to Corporate Governance

Board of Directors (as of June 24, 2024)

| Name | Position and Responsibilities | Representation Authority | Independent Officer | |

|---|---|---|---|---|

| Business executed | Takahito Tokita | CEO, Chairman of the Risk Management & Compliance Committee | ○ | |

| Takeshi Isobe | Representative Director, Corporate Vice President, CFO* | ○ | ||

| Hiroki Hiramatsu | Corporate Executive Officer, SEVP, CHRO | |||

| Non-executive | Hidenori Furuta | Non-Executive Chairman, Member of the Board | ||

| Chiaki Mukai | ○ | |||

| Yoshiko Kojo | Chairman of the Board of Directors | ○ | ||

| Kenichiro Sasae | ○ | |||

| Byron Gill | ○ | |||

| Takuya Hirano | ○ |

FY2023 Attendance at Meetings of the Board of Directors or Audit & Supervisory Board

| Meeting | Number of Meetings | Attendance Rate |

|---|---|---|

| Board of Directors | 18 | 97.5% |

| Audit & Supervisory Board | 11 | 98.2% |

Skills of directors and auditors

As a global company that brings trust to society through innovation and makes the world more sustainable, our company identifies the diversity and skills required for directors and corporate auditors to effectively exercise their advisory and supervisory functions and discloses them in a Skills Matrix.

| Name | Independent | Diversity | Skills Matrix | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Gender | Nationality | Corporate management | Finance and investment | Global | Technology | ESG, academia, and policy | |||

| Representative Director, CEO | Takahito Tokita | Male | JP | ○ | ○ | ○ | |||

| Representative Director, CFO | Takeshi Isobe | Male | JP | ○ | ○ | ○ | |||

| Director and Corporate Executive Officer | Hiroki Hiramatsu | Male | JP | ○ | ○ | ○ | |||

| Non-Executive Chairman, Member of the Board | Hidenori Furuta | Male | JP | ○ | ○ | ○ | |||

| Director | Chiaki Mukai | ○ | Female | JP | ○ | ○ | ○ | ||

| Director | Yoshiko Kojo | ○ | Female | JP | ○ | ○ | |||

| Director | Kenichiro Sasae | ○ | Male | JP | ○ | ○ | |||

| Director | Byron Gill | ○ | Male | US | ○ | ○ | |||

| Director | Takuya Hirano | ○ | Male | JP | ○ | ○ | ○ | ||

| Name | Independent | Diversity | Skills Matrix | ||||

|---|---|---|---|---|---|---|---|

| Gender | Nationality | Legal affairs and compliance | Finance and accounting | Operating process | |||

| Full-time Audit & Supervisory Board Member | Youichi Hirose | Male | JP | ○ | ○ | ||

| Full-time Audit & Supervisory Board Member | Yuuichi Koseki | Male | JP | ○ | ○ | ||

| Audit & Supervisory Board Member | Koji Hatsukawa | ○ | Male | JP | ○ | ○ | |

| Audit & Supervisory Board Member | Hideo Makuta | ○ | Male | JP | ○ | ○ | |

| Audit & Supervisory Board Member | Catherine O'Connell | ○ | Female | NZ | ○ | ||