Fujitsu Risk and Fraud

To analyze financial and sustainability corporate behaviors with transparency and trust

A platform that provides Advanced AI tools for financial and sustainability analysis, including simplification of CSRD reporting for companies, while measuring the impact of sustainability decisions on business growth.

What is Fujitsu Risk and Fraud

Facing a landscape where financial crime is becoming increasingly complex and regulations more stringent, the market demands solutions that not only keep pace but stay ahead.

-

- Sophisticated Fraud

- As financial fraud becomes more complex, Sentinel AI helps to decipher intricate patterns that traditional systems might miss.

-

- Regulatory Pressure

- With stringent compliance requirements, our solution provides the necessary transparency for financial institutions to explain decision-making processes to regulators.

-

- Operational Inefficiency

- The market demands high operational efficiency. Sentinel AI can reduce false positives in fraud detection, streamlining operations and saving valuable resources.

-

- Dynamic Threat Landscape

- Financial fraud tactics are constantly evolving, and our solution can adapt more rapidly to these changes, offering a proactive defense mechanism.

-

- Cost of Fraud

- The financial burden of fraud is substantial. By enhancing detection accuracy, can mitigate losses and reduce the overall cost of fraud to institutions.

Fujitsu Risk and Fraud is an advance AI solution to analyze financial and sustainability corporate behaviors with transparency and trust, providing clear, detailed explanations of AI decisions.

-

-

- Lack of Visibility

- Delivers a clear, explainable financial score to help users understand their financial health and risks.

- Complexity

- Simplifies financial data into actionable, user-friendly insights.

- Trust in AI

- Builds confidence through transparent, explainable AI recommendations.

- Risk Detection

- Quickly identifies financial risks and opportunities with precision.

- Proactive Management

- Enables smarter decisions by predicting risks and suggesting preventive actions.

- Lack of Visibility

Features

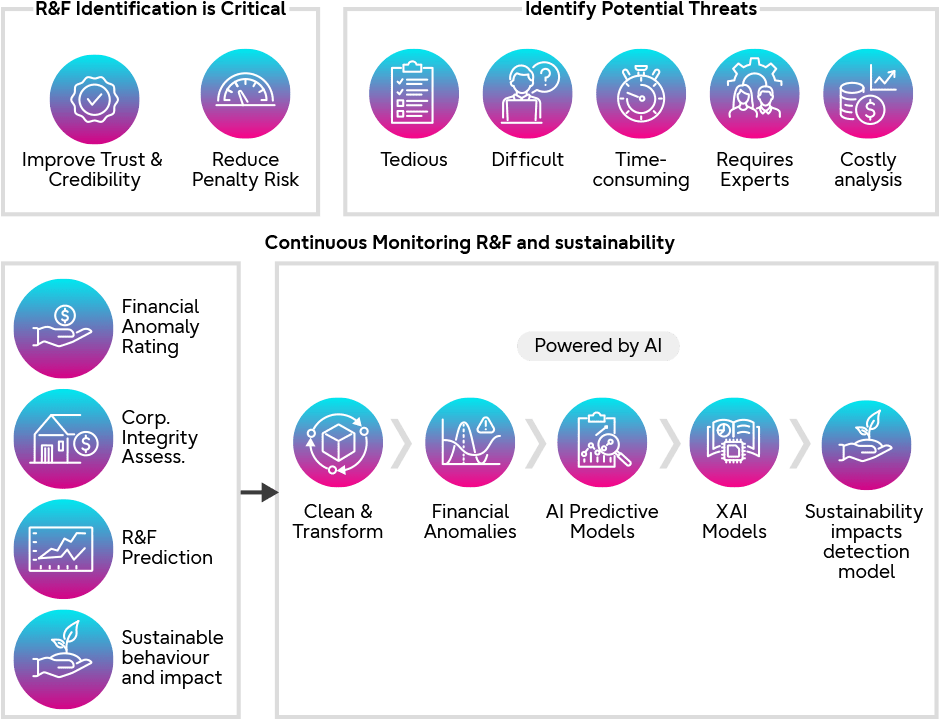

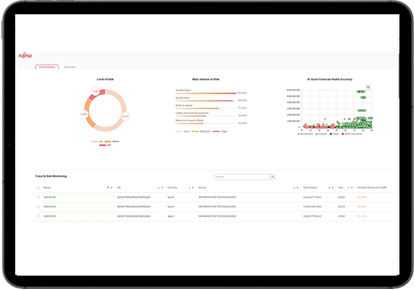

Fujitsu Risk and Fraud(R&F) is a pioneering solution for risk detection and compliance that combines the power of AI technologies available, such as Explainable AI (XAI) and network technologies. It offers organizations the means to detect, prevent, and mitigate risks and fraudulent activities while ensuring compliance with regulatory requirements.

Fujitsu stands apart in the realm of ESG (Environmental, Social, and Governance) analysis through distinct differentiators. Fujitsu leads the charge with its commitment to ESG through innovative practices, including ESG auto-reporting, a process that automates the generation of ESG reports, enhancing transparency and accountability.

Furthermore, Fujitsu integrates financial analysis seamlessly with ESG considerations by leveraging XBRL technology, facilitating a comprehensive understanding of the financial implications of sustainable practice besides complying with European Directives. That will affect more than 55.000 companies.

Fujitsu also stands out by addressing not only European regulations like ESRS but also international directives such as those outlined by the ISSB (International Sustainability Standards Board).

-

Financial Health Score

-

ESG Autotagger

Key Benefits

Fujitsu Risk and Fraud aim to ensure that artificial intelligence (AI) systems are ethical, fair, safe, and transparent. Let's take a closer look at each of the benefits offered by Fujitsu and align with AI Act principles:

-

- Transparency and trust

-

- Detailed explanations

-

- Help identify

biases and anomalies

- Help identify

-

- Improve the quality of

business decisions

- Improve the quality of

-

- Adapting & continuously

improving AI

- Adapting & continuously

-

- Enhanced accuracy and

insights

- Enhanced accuracy and

Fujitsu Risk and Fraud

– working together to solve your business challenges

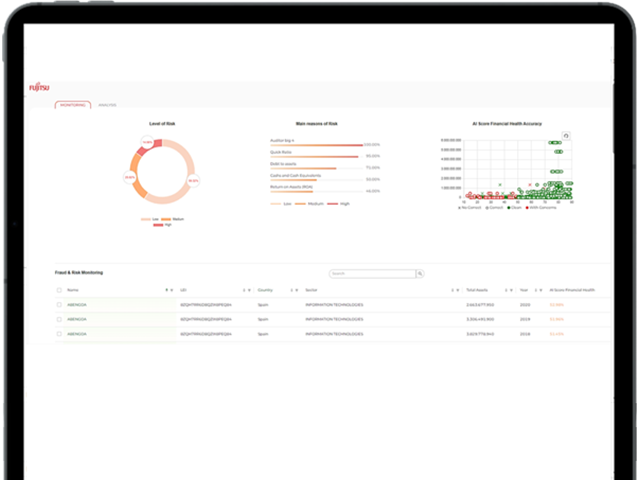

Company scoring (Rating agency)

Challenge

- The leading Data aggregators on financial and business information in Spain and Europe availables different data sources: financial information of companies in the census (annual reports), publications in BORME, auditor´s reports, lawsuits and defaults...

- The data aggregators needs to generate a "reliable financial health score" based on advanced AI technologies which can be self-explainable

Solution

- Develop eXplainability technologies (XAI) for a cutting-edge financial health score, so that we could provide transparent explanations of AI predictions and enhance its interpretability, ensuring that recommendations and predictions are understandable.

Results

- We promote the use of a transparent and reliable AI as a supervision tool that facilitates the identification of key features of business health, such as corporate strength and risky financial practices, shedding light on possible problems in the solvency, profitability or liquidity of companies.

- All this through easily interpretable results from an eXplainable Artificial Intelligence (XAI), which can provide clear explanations about the financial health score and enable the development of new lead recommendations to an enhancement of business health, providing detailed explanations of why specific actions are suggested.

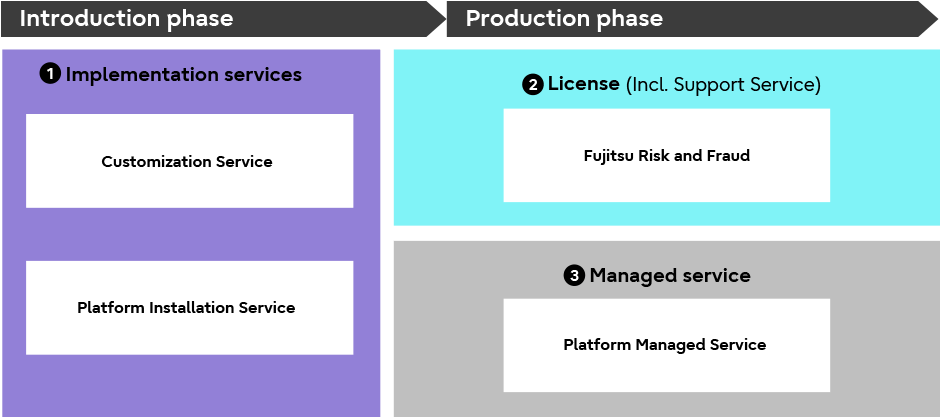

How to get started

| Product Name | Price |

|---|---|

| Fujitsu Risk and Fraud Customization Service | One-off |

| Fujitsu Risk and Fraud Platform Installation Service | |

| Fujitsu Risk and Fraud | Monthly |

| Fujitsu Risk and Fraud Platform Managed Service |

Notice

-

February 28, 2025Information

- This website has been opened.