Fujitsu and LARUS Leverage Power of Graph Database and Graph Explainable AI Technologies to Strengthen Detection of Credit Card Fraud

Kawasaki, Japan, Global, Venice, Italy, November 24, 2020

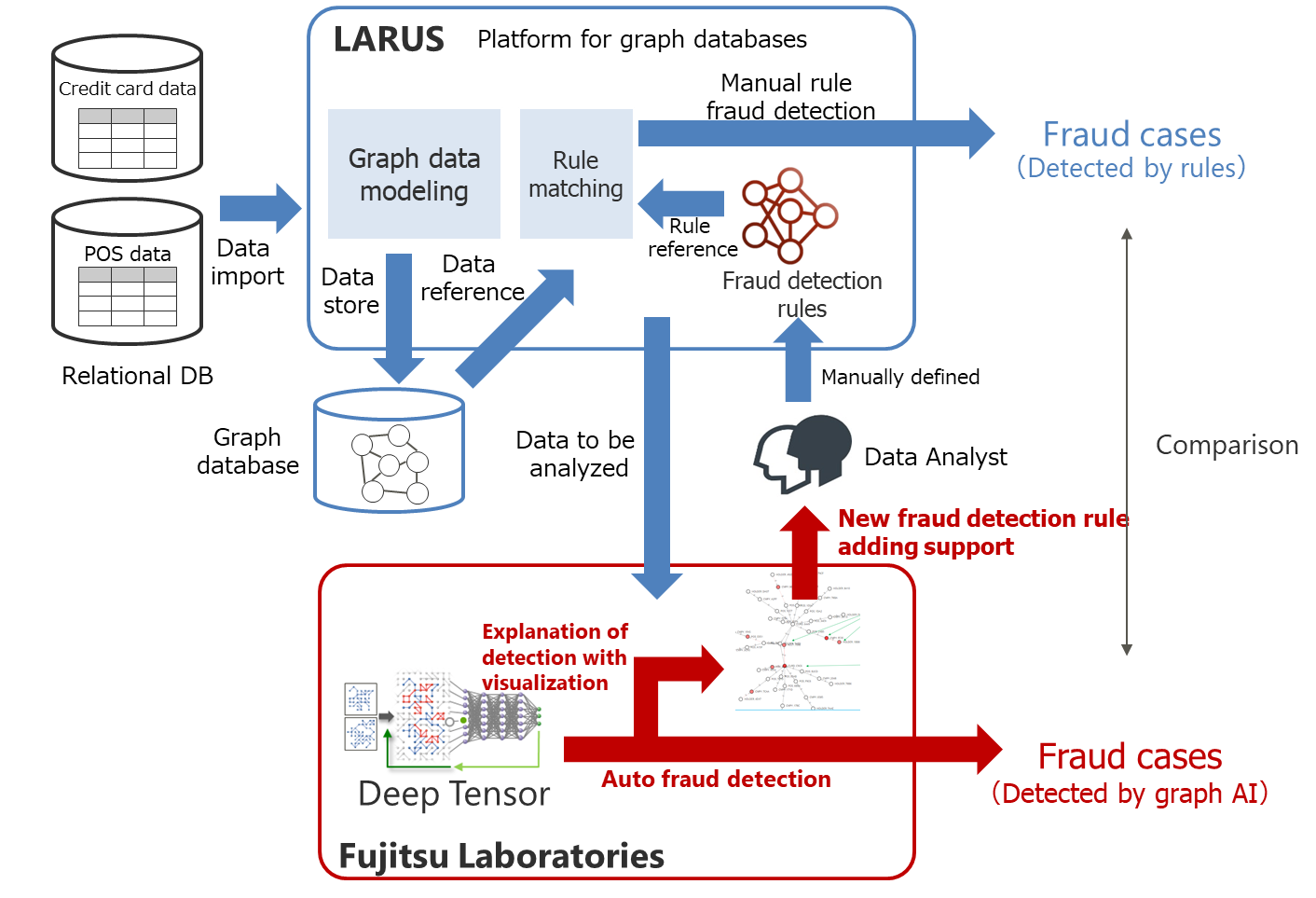

Fujitsu and LARUS achieved this by linking the LARUS platform for graph databases with Fujitsu's graph AI technology. Compared with previous, rule-based approaches created manually by data analysts, the fraud detection rate improved from 72% to 89%, while the false detection rate was successfully reduced by 63%. Additionally, it was confirmed that the creation of rules for fraud detection could be supported by presenting the decision factors of fraud cases detected with graph AI technology. Going forward, both companies will verify the effectiveness of this technology in other industries with the objective of delivering practical uses for graph databases and graph AI.

Detailed results of this verification trial will be demonstrated at the "AI & Big Data Expo Europe 2020" conference, which will be held online from November 23rd, 2020 (Monday) to 24th (Tuesday) Central European Time.

Background

In recent years, there have been growing expectations around the use of graph data in AI applications in various fields and industry verticals, including the analysis of SNS activity history, representation of chemical molecules, financial transactions and tracking of virus infections. Instead of utilizing conventional relational databases(Note4), storing this kind of real-world relationship into a graph database, which underscores the relationships between underlying data elements, enables expression of data elements relationships directly, thereby enabling advanced analysis and discovery of new insights into real-world scenarios.

In the field of finance, for instance, it’s possible to extract important information utilizing graph databases by analyzing the relationships between transactions. Analysis of individual transactions alone remains insufficient, especially for detecting complex, fraudulent transactions, and all transactions must be analyzed together as a graph structure. For example, in the case of self-financing, a type of fraudulent transaction, even if individual transactions appear normal, when the relationship of the different transactions are analyzed together, circular or loop like patterns may become apparent. Graph databases are well suited for detecting fraud from graph patterns like these loops.

To date, there has been a limit to how much data analysts have been able to create rules for fraudulent trading patterns, and concerns persist around the risk of misidentification and false detection. Consequently, it has become necessary to further streamline graph AI technology.

Overview of the Verification Trial

In this trial, table data containing details of individual transactions was converted into graph data expressing the relationship between different data elements. These were subsequently analyzed by combining the platform for graph databases which LARUS provides with Fujitsu Laboratories’ "Deep Tensor" technology. Fujitsu and LARUS used actual credit card data and POS data and verified the degree of improvement with fraud detection rate or false detection rate by comparing with manually created fraud detection rules. In addition, by utilizing the “explanation of detection with visualization” functionality, which is another important feature of "Deep Tensor," it was possible to show the reasoning behind the different decisions to the satisfaction of data analysts.

Outcomes

In the verification of credit card transaction data from a payment services provider, fraud detection rates improved from 72% to 89% and the false detection rate was reduced by an average of 63%, when the new graph AI based approach was used in comparison with the conventional manual, rule-based approach.

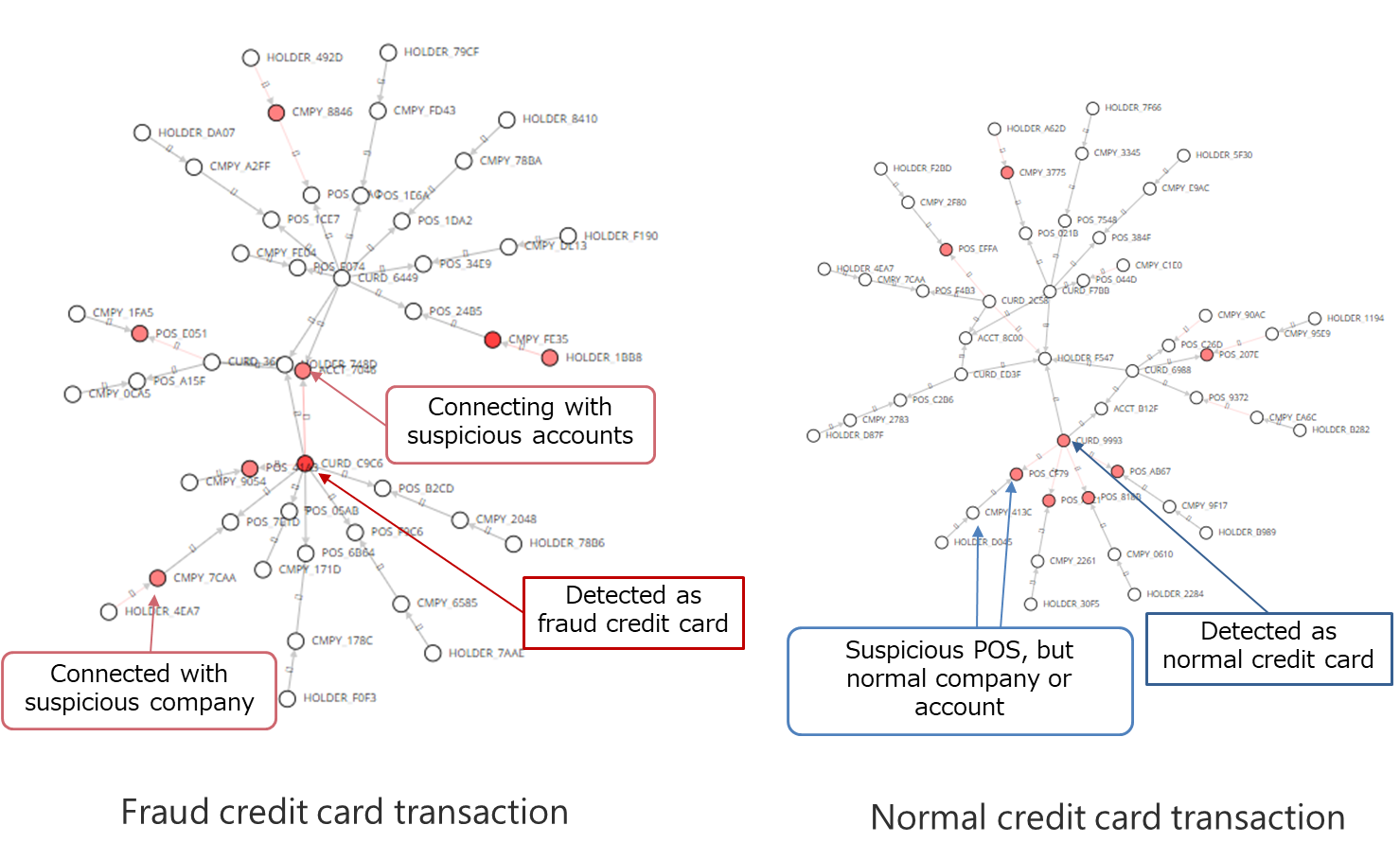

Furthermore, Fujitsu also confirmed that the explanation of detection with visualization was adequate from the viewpoint of the data analyst, making it possible to support the creation of new rules for improved fraud detection. (Figure 2).

Future Plans

In the future, both will additionally verify the technology’s effectiveness with data drawn from different industries, paving the way for the practical use of graph data and graph AI in a broader range of application areas.

Notes

[1] LARUS Business Automation S.r.l.: Headquarter Italy Venice, Founder, CEO Lorenzo Speranzoni

[2] Deep Tensor: An AI technology developed by Fujitsu Laboratories that derives new knowledge from data of a graph structure showing connections between people and things. (October 20, 2016 Press Releases) (https://www.fujitsu.com/global/about/resources/news/press-releases/2016/1020-01.html)

[3] AI graph technology: A technology that maps connections between data elements to help provide context into their relationships

[4] Relational databases: Database stores data in row and column table format.

About Larus

Headquartered in Venice, Italy, LARUS helps companies around the world designing large-scale data-driven platforms based on the latest innovative technologies. As a world-wide top “Premier Solution Partner” of Neo4j, its “Certified Professionals” have been helping universities, institutions and companies succeed with the world’s leading graph database since a decade. LARUS has a wide experience in different domains from government, insurance, financial institutions to manufacturing, retail and telecom with a strong track record and its R&D department works with many universities on several topics from graph data-visualization to graph algorithms and machine learning in order to validate their application to customers’ use cases.About Fujitsu

Fujitsu is the leading Japanese information and communication technology (ICT) company offering a full range of technology products, solutions and services. Approximately 130,000 Fujitsu people support customers in more than 100 countries. We use our experience and the power of ICT to shape the future of society with our customers. Fujitsu Limited (TSE:6702) reported consolidated revenues of 3.9 trillion yen (US$35 billion) for the fiscal year ended March 31, 2020. For more information, please see www.fujitsu.com.About Fujitsu Laboratories

Founded in 1968 as a wholly owned subsidiary of Fujitsu Limited, Fujitsu Laboratories Ltd. is one of the premier research centers in the world. With a global network of laboratories in Japan, China, the United States and Europe, the organization conducts a wide range of basic and applied research in the areas of Next-generation Services, Computer Servers, Networks, Electronic Devices and Advanced Materials. For more information, please see: http://www.fujitsu.com/jp/group/labs/en/

Press Contacts

Public and Investor Relations Division

Inquiries

Company: Fujitsu Limited

LARUS Business Automation S.r.l.

E-mail: info@larus-ba.it

Fujitsu, the Fujitsu logo and “shaping tomorrow with you” are trademarks or registered trademarks of Fujitsu Limited in the United States and other countries. Other company or product names mentioned herein are trademarks or registered trademarks of their respective owners. Information provided in this press release is accurate at time of publication and is subject to change without advance notice.

Date: November 24, 2020

City: Kawasaki, Japan, Global, Venice, Italy

Company: Fujitsu Laboratories, Ltd., Fujitsu Laboratories of America, Inc.