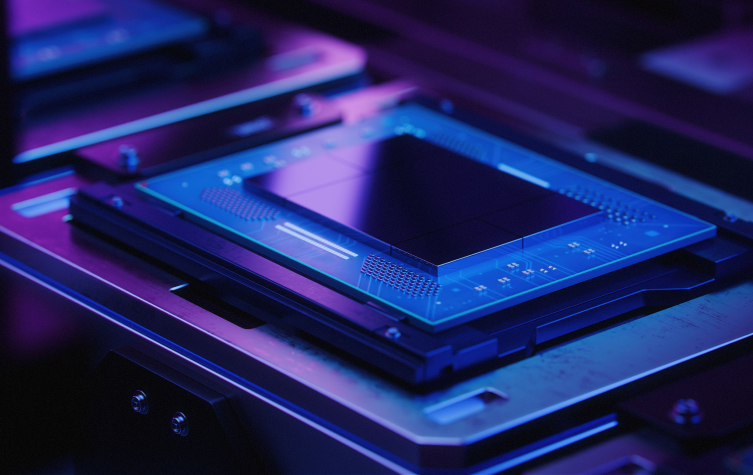

Our technology vision

We believe that technology holds the key to building regenerative enterprises that thrive sustainably. By harnessing advanced solutions the power of artificial intelligence, cutting-edge cybersecurity, and application modernization, we empower businesses to not only achieve their goals but also contribute positively to the environment and society.

Artificial Intelligence

Unlock your business potential with AI and automation services, driving efficiency and innovation.

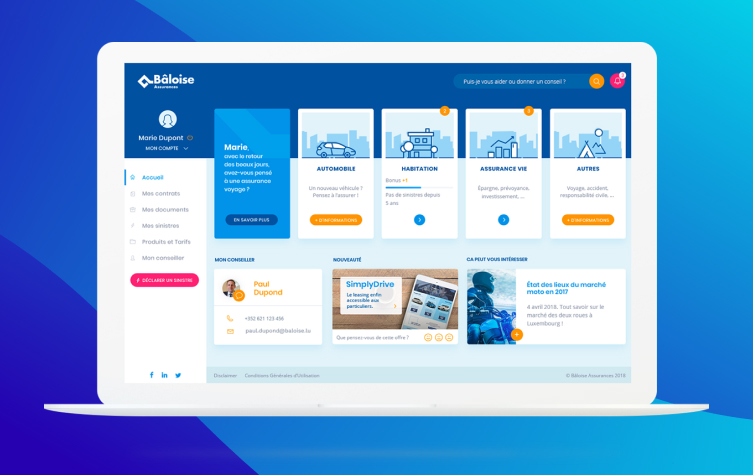

Application Modernization

Revitalize your business with our app modernization services, enhancing performance and agility.

Cybersecurity

Protect your business with our advanced cybersecurity solutions, ensuring safety and resilience.

Make change possible

Fujitsu helps companies transform into regenerative businesses that not only create economic value but also sustainably improve the well-being of people and the environment.

Carrying a vibrant company life!

We are convinced that embracing human diversity is key to creating a brighter future in an increasingly digital and diverse world. Our commitment is to build a skilled and varied workforce by tapping into the broadest talent pools.