Tokyo, May 15, 2017

Fujitsu today announced it is commencing sales in Japan of cloud-based solutions for lending and leasing businesses. Developed by US-based Cloud Lending Solutions and known as the CL Series, the solutions will be deployed and operated as Software as a Service (SaaS) with the support and operations services of Fujitsu technicians with expertise in financial systems. This is the first time services from Cloud Lending Solutions will be available in Japan.

Using these solutions, customers can now set up SaaS-based systems quickly, and at low cost, for a suite of business processes related to lending and leasing businesses.

ALT Corporation, a subsidiary of Yayoi Co., Ltd., Japan's largest accounting software company, has decided to become the first Japanese customer for these solutions. ALT is using these solutions to set up a unique online lending business, with plans to begin trial lending in October 2017.

Going forward, Fujitsu plans to expand these solutions sequentially, first to the Asia-Pacific region, and then around the world.

These solutions will be exhibited at Fujitsu Forum 2017, to be held at the Tokyo International Forum (Chiyoda-ku, Tokyo) on May 18-19.

Background

With the goal of offering solutions to transform business using Fintech to customers at financial institutions around the world, on July 12, 2016, Fujitsu signed a Memorandum of Understanding (MOU) with Cloud Lending Solutions for a strategic partnership. Continuing the partnership on the basis of this MOU, Fujitsu has now signed a contract with Cloud Lending Solutions to become its first sales agent in Japan. Fujitsu will from today offer solutions that combine Cloud Lending's CL Series SaaS, which digitize a suite of business processes for lending and leasing businesses, from applications to reviews, contracts, and collections, with broad support from deployment to operations from Fujitsu's technicians, who offer thorough experience and a rich track record in building financial systems, and in support and service.

Features of These Solutions

The CL Series is a set of cutting-edge cloud services offered as SaaS, which digitize a suite of business processes for lending and leasing businesses, from applications to reviews, contracts and collections.

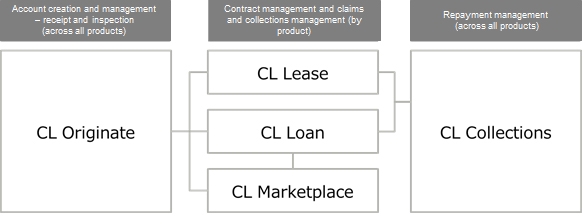

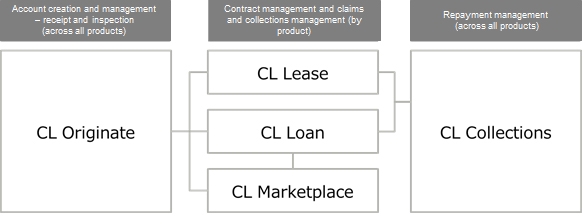

Offerings include CL Originate, which automatically reviews the information submitted by the applicant based on a pre-set scoring model(1), and manages the process until the contract is closed based on that review, CL Loan, which manages the status of claims and collections for the loan amount and the progress of the contract for each applicant based on the type of contract, CL Lease, and CL Collections, which manages overdue situations for credit collections. The series consists of five modules in total, also including CL Marketplace, supporting crowd financing, in which capital gathered from recruited investors is lent out, and collected capital is returned to investors. Customers can select the number of licenses needed for the necessary modules.

Using its experience with financial operations and abundant track record of building financial systems over many years, Fujitsu is offering the CL Series in combination with total support, including operations and deployment support suited to the customer's system environment. This makes it possible to rapidly migrate traditional systems for lending and leasing businesses, built in an on-premises environment, to cutting-edge cloud systems. Moreover, even customers who are entering the lending or leasing business for the first time using Fintech can set up high-quality business systems in a short time and at low cost.

Figure 1: Diagram of the CL Series

Figure 1: Diagram of the CL Series

Future Plans

Continuing on from this expansion into Japan, Fujitsu will localize these solutions according to the languages and laws of various countries, expanding these solutions first to customers in the Asia-Pacific region, and thereafter sequentially expanding availability around the globe.

Pricing and Availability

| Product Name |

Pricing |

Availability |

| CL Originate |

By individual estimate |

May 15, 2017 |

| CL Loan |

| CL Lease |

| CL Marketplace |

| CL Collections |

| Deployment Support Service |

| Operations Service |

Related Links

"Fujitsu and Cloud Lending Solutions to Deliver New Fintech Solutions to Financial Institutions in Japan and Asia Pacific," (press release, July 12, 2016)