Archived content

NOTE: this is an archived page and the content is likely to be out of date.

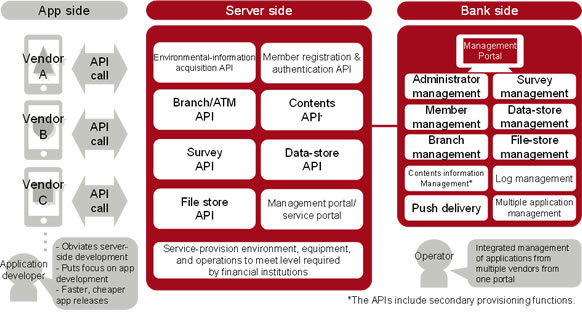

Fujitsu Enables Fast Fintech for Nanto Bank with mBaaS Smartphone Application Service Platform

A first for a regional bank in Japan, mobile Backend as a Service realizes faster provisioning and integrated management of fintech services

Fujitsu Limited

-

[1] Mobile Backend as a Service (mBaaS)

A type of PaaS in which all of the functions required to develop and run smartphone applications, including push notifications and member authentication, are implemented in advance as a service platform on a cloud-based server. Because these functions are built in advance, developers do not need to start from scratch, which greatly reduces development costs and development times.

-

[2] Security Guidelines on Computer Systems for Banking and Related Financial Institutions

Guidelines published as common approaches to security for financial-information systems, created independently as standards for computer systems in financial institutions, insurance companies, securities companies, etc.

-

[3] Center for Financial Industry Information Systems (FISC)

A non-profit organization that sets standards for security and oversight in information systems used by financial institutions.

-

[4] First Japanese regional bank to use mBaaS

As found by Fujitsu as of December 25, 2015.

-

[5] O2O

Online-to-Offline. Uses online media to promote offline visits to a physical location, or uses information generated by online contact to influence offline shopping behaviors.

-

[6] Fintech

Finance and Technology. Aims to eliminate inefficiencies in existing financial services through the use of smart devices and big-data analysis, and to provide more innovative financial services.

-

[7] Fintech company

Fintech services are financial services that combine advanced ICT and financial expertise, and startups that provide these services are called fintech companies.

-

[8] API

An abbreviation for "Application Programming Interface," which refers to the orders, rules, and functions used during programming.

About Fujitsu

Fujitsu is the leading Japanese information and communication technology (ICT) company, offering a full range of technology products, solutions, and services. Approximately 159,000 Fujitsu people support customers in more than 100 countries. We use our experience and the power of ICT to shape the future of society with our customers. Fujitsu Limited (TSE: 6702) reported consolidated revenues of 4.8 trillion yen (US$40 billion) for the fiscal year ended March 31, 2015. For more information, please see http://www.fujitsu.com.

All company or product names mentioned herein are trademarks or registered trademarks of their respective owners. Information provided in this press release is accurate at time of publication and is subject to change without advance notice.

Date: 25 December, 2015

City: Tokyo

Company:

Fujitsu Limited