Archived content

NOTE: this is an archived page and the content is likely to be out of date.

FUJITSU Enterprise Application PRO-NES

Financial System

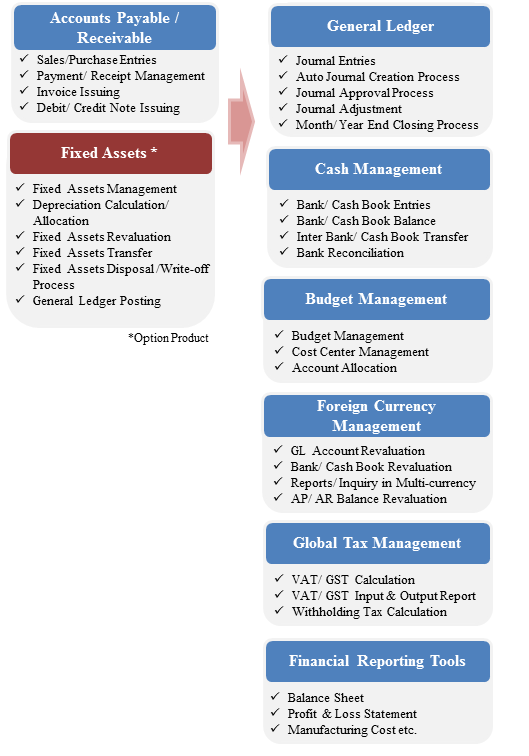

Financial system provides comprehensive accounting solution for company-wide financial management. It is tightly integrated to Manufacturing modules. Transaction resulted from shipment and goods receipts are generated automatically as Accounts Receivable and Accounts Payable in the system, eliminating duplication of work and reduce human error.

Financial System comprises of Accounts Payable, Accounts Receivable, General Ledger, Reporting Tools and Fixed Assets* Modules.

[Financial System Key Features]

System Benefits

- Improve journal entries efficiency

Besides the manual journal creation, all Accounts Receivable, Accounts Payable, Costing transactions related to production can be journalized automatically. (by real time or periodically)

Besides the manual journal creation, all Accounts Receivable, Accounts Payable, Costing transactions related to production can be journalized automatically. (by real time or periodically)  Template features enable you to eliminate unnecessary human entry error and save time during the creation of new journal.

Template features enable you to eliminate unnecessary human entry error and save time during the creation of new journal. Support automatic calculation of allocation amount for each cost center according to the percentage defined in the template.

Support automatic calculation of allocation amount for each cost center according to the percentage defined in the template.- Accelerate closing process

Full integrated with manufacturing system enable you to eliminate the need for duplicate data entry, reduce the mistake in journal and shorten the lead time of financial closing.

Full integrated with manufacturing system enable you to eliminate the need for duplicate data entry, reduce the mistake in journal and shorten the lead time of financial closing.

Template features enable you to speed up voucher creation process and prevent posting to incorrect accounts.

Template features enable you to speed up voucher creation process and prevent posting to incorrect accounts.

Centralizing financial information to realize fast decision-making and multiple angles of business data analysis.

Centralizing financial information to realize fast decision-making and multiple angles of business data analysis. - Real-time visibility into your company's finances

Support download necessary system data into Excel form for analysis or decision-making purposes.

Support download necessary system data into Excel form for analysis or decision-making purposes.

The financial reporting tools in Financial System enable you to define your financial report layout freely.

The financial reporting tools in Financial System enable you to define your financial report layout freely.

Dashboard features enable you to visualize your financial data and generate management report from various points of view.

Dashboard features enable you to visualize your financial data and generate management report from various points of view. - Country specific tax compliance

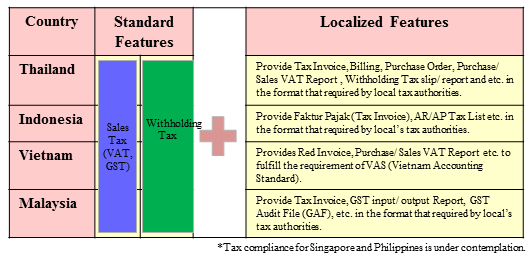

Standard and localized features which meet individual country tax calculation and accounting standard requirement enables enterprises to roll-out their system to global subsidiaries within short period of time.

Standard and localized features which meet individual country tax calculation and accounting standard requirement enables enterprises to roll-out their system to global subsidiaries within short period of time.

Standard tax reports which required by individual country are provided under localized features.

Standard tax reports which required by individual country are provided under localized features.

Support tax reform in your country by updating system features when necessary.

Support tax reform in your country by updating system features when necessary.

- Maintain your fixed assets easily and accurately

Automatic calculation of depreciation according to the setting in fixed asset registration (such as depreciation method, useful life etc.).

Automatic calculation of depreciation according to the setting in fixed asset registration (such as depreciation method, useful life etc.).

Seamless integration with General Ledger Module in Financial System.

Seamless integration with General Ledger Module in Financial System.

Standardizing company-wide fixed assets data.

Standardizing company-wide fixed assets data.

Tax compliance through PRO-NES

- Key features for Value-Added Tax (VAT)

Calculate taxes that are levied on the value (price) added at each purchase/ sales goods and services task item.

Calculate taxes that are levied on the value (price) added at each purchase/ sales goods and services task item.

Parameter to setup VAT rate based on VAT code.

Parameter to setup VAT rate based on VAT code.

Enable to create journal voucher for the purchase/ sales VAT and posted to GL.

Enable to create journal voucher for the purchase/ sales VAT and posted to GL.

Support undue services VAT operation. User can setup an account in General Ledger that temporarily holds VAT expenses from services invoices. After the invoice is paid, the VAT is transferred to the regular VAT expense account.

Support undue services VAT operation. User can setup an account in General Ledger that temporarily holds VAT expenses from services invoices. After the invoice is paid, the VAT is transferred to the regular VAT expense account.

Generate VAT reports that you can submit to your tax authorities.

Generate VAT reports that you can submit to your tax authorities. - Key features for Withholding Tax

Record and report withholding taxes applying in relation to any provision of services during payment, receipt and journal entry.

Record and report withholding taxes applying in relation to any provision of services during payment, receipt and journal entry.

Enable to create journal voucher for the paying/ receiving withholding tax and posted to GL.

Enable to create journal voucher for the paying/ receiving withholding tax and posted to GL.

General withholding tax reports that can submit to your tax authorities.

General withholding tax reports that can submit to your tax authorities.

PRO-NES Sample Screen Image

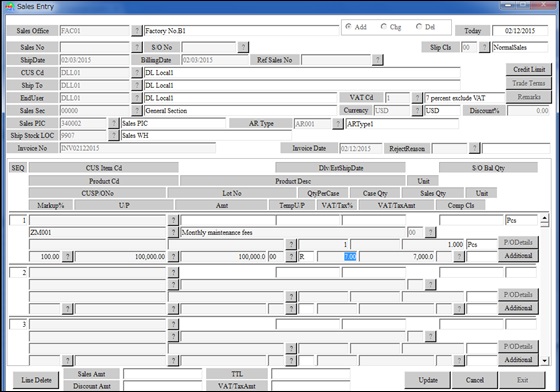

Sales Entry

Sales Entry

Register sales data for miscellaneous item.

Register sales data for miscellaneous item.

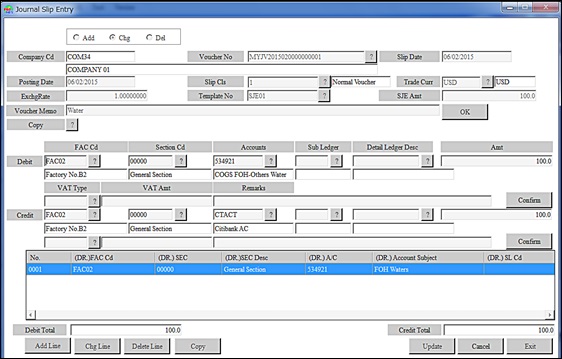

Journal Slip Entry

Journal Slip Entry

Create journal data based on standing journal template.

Create journal data based on standing journal template.

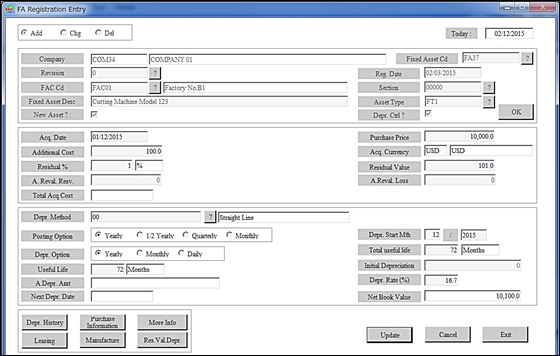

FA Registration

FA Registration

Setup the basic information for the fixed assets.

Setup the basic information for the fixed assets.