Want to know more about how Fujitsu can help you achieve your sustainable transformation?

Comerica:

Victoria Mutual: The journey from 'doing digital' to 'being digital'

Sheena Wedderburn-Reid, Chief Digital Officer for Jamaica’s Victoria Mutual Group, describes the pillars that have underpinned a comprehensive — and impactful — digital transformation strategy - by Kenny MacIver

Anyone observing the 2017 information technology strategy of Victoria Mutual (VM), the Jamaica-headquartered financial services group, would have seen a to-do list as conservative as might be expected from a 143-year-old institution. As part of a J$2.2 billion (US$17.6m) investment program, the group — whose activities span mortgages and loans, banking and money transfers, wealth management, insurance, real-estate services and pensions — was solidly pushing ahead with multiple IT initiatives for upgrading core banking and investment management and enhancing online banking and customer onboarding.

What that highlighted was that IT (rather than digital) still dominated VM’s thinking on the application of financial technology, something perhaps reflected in the fact that ‘digital’ only warranted a mention six times in the company’s 170-page 2017 annual report.

Behind the scenes, though, all that was about to change. Around the VM boardroom table, a management team led by the group’s recently appointed President and CEO, Courtney Campbell, was devising what amounted to a company metamorphosis — an acknowledgement that nothing short of a digitally enabled business transformation would prepare the group for the industry-reshaping power of fast-advancing technology and customers’ changing expectations.

As Chief Digital Officer for the VM Group, Sheena Wedderburn-Reid has witnessed that transformation firsthand, becoming one of the primary drivers of a digital strategy that now spans every dimension of VM, from its application of advanced tech and the fostering of a digital culture to the growth of new business models and the development of a tech partner ecosystem.

Tech-driven forces

“We’re living in a particularly amazing time when technology is king and digital is everywhere. The digital economy is developing at a phenomenal rate, changing our lives — the way we live, socialize, shop, entertain ourselves, learn, communicate and work,” says Wedderburn-Reid. “Tech megatrends such as AI, IoT, robotics and blockchain are fundamentally changing our entire business landscape. And while the digital economy presents a huge potential for all kinds of businesses, the ensuing disruption has already led to the destruction of many traditional value chains and businesses across the world.”

Traditional financial services companies — encumbered by legacy, siloed systems and inflexible processes — are in many ways sitting targets for such disruptors. But as many large companies have found to their cost, simply acquiring advanced technologies does not equate to “truly driving the required transformation,” she warns. “Rather, the focus needs to be on the confluence of powerful tech and the new business strategies of the organization. That is what moves the needle and [changes] the organization from simply doing digital to actually being digital.”

“Being digital is the ability to transform the way the organization operates as an entity, across its people, its processes and its technologies — all to the delight of its customers.”

For Wedderburn-Reed — and VM — the notion of being digital is not about streamlining selective processes, digitizing aspects of manual labor or keeping the operation’s IT running smoothly. Instead, being digital refers to “the ability to transform the way the organization operates as an entity, across its people, its processes and its technologies — all to the delight of its customers.”

In its five-year quest to become a digital master, VM has sought to build the capability to actively and repeatedly exploit new and emerging technologies, dramatically enhance customer services, drive significantly higher levels of profitability, productivity and performance, and in parallel to create new models for generating the business of the future.

Redrawing the starting line

“That’s our thinktank, where we all have a role in considering what strategies and actions need to be in play, who’s accountable for what, and what measures we are going to have as part of that accountability,” he says. “That foundational piece is critical as the individuals in that group have the biggest influence on making change happen in the organization.”

What’s more, no topic is ever off the table. “We have very contentious, very free conversations. We talk about racial equity, individual identity, culture, values. What is the need of the organization? Where are we missing the boat? What are our opportunities? What’s right from wrong? And what do we do? What are our employees telling us?”

Sheena Wedderburn-Reed, Chief Digital Officer, Victoria Mutual Group

Sheena Wedderburn-Reed, Chief Digital Officer, Victoria Mutual Group

That was the starting point for VM three years ago.

In 2018, we recognized that we were actually busy doing digital rather than being digital. We had plenty of technology projects on our agenda and in our pipeline but these were, for the most part, disparate, disconnected initiatives. And while the projects at the time did have linkages to our key strategic goals, they did not tie into a cohesive digital strategy or program,” says Wedderburn-Reid.

“So a very deliberate element of our focus for the transformation program was that it had to be holistic. Rather than continuing the trend of developing distinct digital solutions, we wanted the transformation effort to be one that was sustainable and repeatable, supporting a journey that would take us to a future state,” says Wedderburn-Reid. The aim was to infuse and unify a set of strategic business goals — of being a strong, integrated financial group, an employer of choice, a modern mutual financial services group and a model corporate citizen — with a digital strategy.

The temptation at the start of the journey, she says, was to focus on filling technological gaps. However, when VM asked technology partners, including Fujitsu, to assess its digital capabilities and how they should evolve, the same fundamental questions came back: “What ultimately are you trying to achieve?

What is your business aspiration and strategy? Because those are going to guide the technological roadmap that you build and the solutions that you implement.”

Without a clear answer, the VM management team realized it needed to take a step back from discussions of technologies and architectures and set about defining a new vision and a digital strategy that would empower that.

Seven pillars to being digital

Central to the digital transformation program that VM devised are seven pillars which have underpinned the complex processes of moving the organization from “doing digital to being digital” — and which Wedderburn-Reid argues are a checklist for any organization’s senior management team trying to deliver transformational business outcomes, irrespective of the industry sector they operate in.

01 Customer experience

Acknowledged digital masters such as Netflix, LEGO, Burberry and Nike have attained much of their success by rooting their strategies in great customer experience, Wedderburn-Reid observes. “By knowing their customers, their wants and needs, these companies create that experience with each and every interaction with the organization.”

“Organizations that are truly digital have a methodology woven into their strategies that helps them gain a deep understanding of their customers.”

Some key technologies that were unimaginable a decade or two ago now support such customer-centricity, she points out. “Social media lets us hear the voice of our customer; mobile devices allow our customers to engage with the brand while on the move; customer analytics allow us to make real-time decisions and predictions and deliver a truly personalized experience to customers.”

She continues: “Organizations that are truly digital have a methodology woven into their strategies that helps them gain a deep understanding of their customers, so they’re able to design an experience that generates the highest levels of satisfaction. And our efforts are centered on leveraging technologies to deliver an unmatched digital experience at all touchpoints to customers, so that we can get closer to them and closer to better serving them.”

At VM, that ambition is channeled through its Customer Experience Transformation program, a three-year effort currently focused on two of its core lines of business — mortgages and wealth management. That program dives deep into customer desires and pain points across the life cycle of the relationship, says Wedderburn-Reid, drawing extensively on direct input from customers; it uses techniques such as customer mapping and design thinking to develop solutions in an agile way that helps to ensure outcomes meet customers’ needs and expectations.

At VM, that ambition is channeled through its Customer Experience Transformation program, a three-year effort currently focused on two of its core lines of business — mortgages and wealth management. That program dives deep into customer desires and pain points across the life cycle of the relationship, says Wedderburn-Reid, drawing extensively on direct input from customers; it uses techniques such as customer mapping and design thinking to develop solutions in an agile way that helps to ensure outcomes meet customers’ needs and expectations.

She candidly points out that prior to the program, VM was scored poorly by customers on the digital channels that were selected for focus under the new program, specifically when they were asked if they’d recommend these digital services to others. However, now midway through the program, such net promoter scores are much enhanced.

At VM, that ambition is channeled through its Customer Experience Transformation program, a three-year effort currently focused on two of its core lines of business — mortgages and wealth management. That program dives deep into customer desires and pain points across the life cycle of the relationship, says Wedderburn-Reid, drawing extensively on direct input from customers; it uses techniques such as customer mapping and design thinking to develop solutions in an agile way that helps to ensure outcomes meet customers’ needs and expectations.

She candidly points out that prior to the program, VM was scored poorly by customers on the digital channels that were selected for focus under the new program, specifically when they were asked if they’d recommend these digital services to others. However, now midway through the program, such net promoter scores are much enhanced.

02 Data analytics

Accurate, complete and timely data has always been a prerequisite for success with digital programs — and that’s even truer for companies working on digital transformation, Wedderburn-Reid highlights. “The power in the data maintained by your organization is immeasurable. When exploited, it can substantially increase your insights, drive better decisions and enable greater efficiencies and cost savings. Data analytics are also the lifeblood for designing a compelling user experience,” she says.

The big challenge here is to be able to take advantage of the ever-growing availability of data from a vast number of different sources and platforms. “That requires the creation of a solid data strategy, and the implementation of the right tools, data management processes and analytical capabilities that can enable accurate insight and, ultimately, better decisions,” she says.

As an organization with disparate systems and non-homogenous data formats, the application of such a data strategy has not been straightforward. “When it comes to data, the desired state VM is aiming for is one single, central source of the truth. And the data team is putting in the hard work to get there by improving on the quality of our data, building out performance dashboards and business intelligence reporting tools across our different units, all with the aim of driving more effective usage of this key resource.”

03 New digital products

On the customer-facing side, VM is acutely aware of the pressing need to provide a modern suite of digital solutions that customers with different requirements and levels of digital know-how can access easily. “Digitally engaged customers today expect products and services tailored to their specific needs,” says Wedderburn-Reid. “They want easy access to solutions at any time and on whichever platform they choose.”

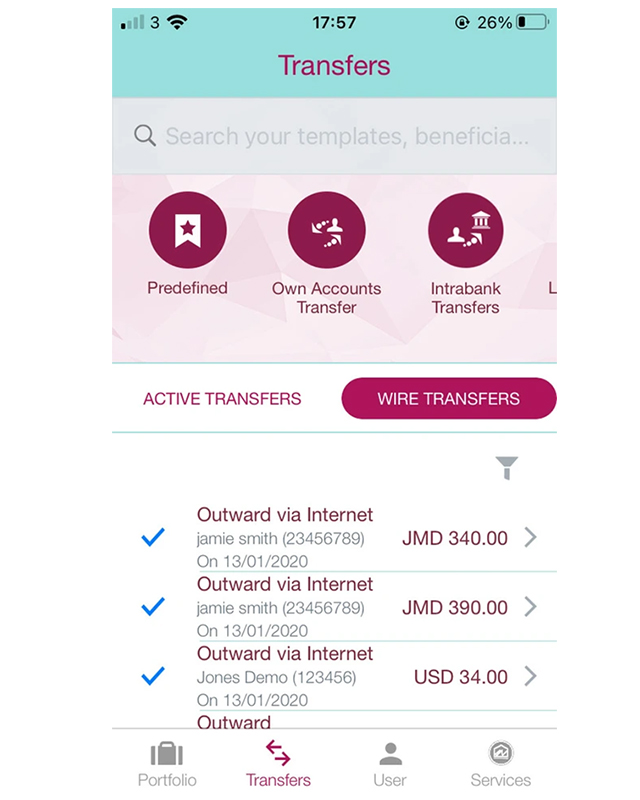

At VM, this has seen a digital reinvention of many of the services associated with physical branches. There has been specific focus on expanding their online capabilities and mobile channels for services such as deposits, withdrawals, transfers, and general account management, with a view to enhancing the members’ and clients’ experience right across the Group.

04 Digital capabilities

For Wedderburn-Reid, one pillar stands out as the most common source of potential failure for any digital transformation strategy: the challenge of building up digital capabilities across the organization’s employee base and establishing a digital work culture. Getting there at VM has involved some dexterous change management.

“For us to succeed at being digital, we recognized from the outset that we had to establish a focus on digital culture, and on the mindset and behavioral changes that would encourage our people to want to be a part of a digital organization,” she says.

Virtually supporting clients, members and employees throughout the pandemic.

Virtually supporting clients, members and employees throughout the pandemic.

“It’s been paramount to give our people the skills they need for what we’re asking of them, and to build an atmosphere that inspires them.”

To make that a reality, VM has applied a groupwide Digital Capability Building Program that has encouraged employees to think and act in agile, innovative, data-driven ways.

“We’ve spent a lot of time outlining why it is important that we make this change in order to build a great future for the organization. Of course, there have been pockets of resistance — often created by people’s fear that they may not have all the capabilities to perform in this new digital environment. So it has been paramount to give our people the skills they need for what we’re asking them to do, and to build an atmosphere that inspires them to do that.”

“We’ve spent a lot of time outlining why it is important that we make this change in order to build a great future for the organization. Of course, there have been pockets of resistance — often created by people’s fear that they may not have all the capabilities to perform in this new digital environment. So it has been paramount to give our people the skills they need for what we’re asking them to do, and to build an atmosphere that inspires them to do that.”

Such a digital culture needs to establish an atmosphere that fosters agile thinking and innovation, where failure is seen as a learning opportunity and senior leaders understand that the organization is uncharted territory, she says. “Employees need to be empowered to explore new ideas, to experiment, and take ownership at operational levels for implementing new innovations, always looking for new ways to test and improve in their own focus areas. Rapid, data-driven decision-making is a critical aspect because it puts the power in the hands of the team members.”

Such a digital culture needs to establish an atmosphere that fosters agile thinking and innovation, where failure is seen as a learning opportunity and senior leaders understand that the organization is uncharted territory, she says. “Employees need to be empowered to explore new ideas, to experiment, and take ownership at operational levels for implementing new innovations, always looking for new ways to test and improve in their own focus areas. Rapid, data-driven decision-making is a critical aspect because it puts the power in the hands of the team members.”

“If you all get that change management right, it creates an ecosystem of collaboration,” she says.

Empowered partnerships

But new models of collaboration also need to extend beyond the organization’s walls. “From the start, there needs to be a determination that you can’t do this alone. To make the journey successful, you need to create an ecosystem that blends the organization’s teams with the vendors they need to partner and engage with,” she says. That is also a major way to create the necessary velocity.

“What was instrumental for us was speed in the delivery of the solutions that we needed to put out for our customers and our clients. We recognized that to be nimbler, to move more quickly, to get to market faster, closer partnerships were critical,” says Wedderburn-Reid. As a consequence, VM has recently revamped its vendor management framework and policies groupwide, so its teams all know exactly what protocols to follow to speedily forge partnerships and get services on board.

She cites the example of the company’s engagement with digital transformation company Fujitsu, a long-term partner. “When we were setting out to devise our digital transformation strategy in 2018, Fujitsu was top of mind for assisting us,” she says. Since then, Fujitsu has partnered with VM to deliver Microsoft services and more recently to assist with a key data analytics initiative.

“Fujitsu has been working closely with our digital team to provide the required support in developing a solution for sentiment analysis that utilizes Microsoft text analytics, a solution that will be expanded to our Customer and Brand team once we have successfully completed testing. And of course, based on our roadmap and our continued work on this transformation, there are many ways that we can explore deepening this relationship with Fujitsu.”

05 New digital business models

The exploration of new business models and sources of revenue is also high on the VM agenda. “While the innovation of operations, workforce and customer offerings can pay big dividends, the most profound transformational undertaking for any company will be changes to its business models,” outlines Wedderburn-Reid. As is all too evident in the world of financial services, traditional business models that have previously enjoyed long-standing favor in the market are now under threat from emerging models powered by innovation and advanced digital technologies, she adds.

She argues that every digital transformation strategy needs to seek out opportunities for new digital business models that might redefine the types of products and services it offers and create entirely new revenue streams for the future. To that end, VM has been developing new digital business models through the relatively recently established arm, VM Innovations.

06 Digital process

While digitally transforming internal operations and processes may not seem as compelling a prospect as transforming the experiences of customers, Wedderburn-Reid argues, the two are co-dependent.

“By focusing on fixing, automating, streamlining your back-office processes, you’ll create a well-oiled, well-tuned engine that will allow you to be more productive, to be more agile and will ultimately enable you to create perceptively better experiences for your team members and your customers,” she says. “A lot of organizations have focused on their strategies on the customer side of things. But in industry after industry, those companies with better operational capabilities tend to create greater competitive advantage.”

07 Digital risk and security management

As companies look to digital transformation, they must also ensure they transform their security capabilities in parallel, urges Wedderburn-Reid, so they build resilience and trust into their increasingly public-facing portfolio of digital offerings.

“While the digital transformation of your organization presents a wide range of opportunities for you to generate value, some of the most prevalent challenges relate to the security of your expanded digital presence. With more of your applications, data and processes in the digital realm, there is now a larger attack surface and more points of entry for hackers and cybercriminals,” she highlights.

Although the pillars are critical for a successful digital transformation journey, they cannot be applied without robust oversight. “It’s absolutely imperative that there is a governance program that runs alongside the execution of your digital strategy. The sheer number of technologies that can be applied as part of such strategies is mind-boggling. So there needs to be careful consideration of where you want to spend your digital dollars and how investments in digital will create value for your organization of stakeholders and for your customers. One of the inescapable truths of digital transformation is that there is a real opportunity to truly waste money chasing new shiny tech that may not pan out.”

Tracking the risks and value associated with any solutions being developed and rolled out is the VM’s digital governance committee, which is chaired by Wedderburn-Reid and includes all the heads of the Group’s lines of business, not least because VM believes that its transformation has to be driven from the highest level in the organization.

Delivering on the transformation agenda

With around 60% of its transformation roadmap now completed, VM Group can point to some major successes, including the delivering of game-changing applications and services. Wedderburn-Reid has several that she’s most proud of:

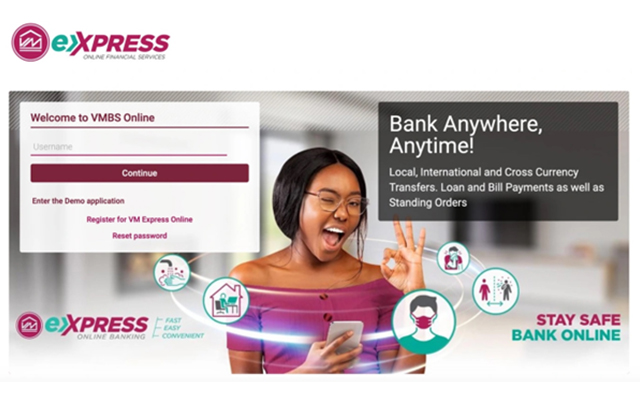

VM Express Mobile, the company’s first mobile banking app, introduced in early 2020, which significantly expanded the set of digital capabilities available to its members online, allowing them to view account activity, pay bills, transfer funds and more from mobile devices.

Virtually supporting clients, members and employees throughout the pandemic.

Virtually supporting clients, members and employees throughout the pandemic.

Virtually supporting clients, members and employees throughout the pandemic.

Virtually supporting clients, members and employees throughout the pandemic.

A major upgrade to the VM Online Banking platform that has helped raised customer satisfaction to new levels.

A self-service Wealth Client Management Platform that allows customers to view and manage their investment portfolios online for the first time.

In 2020, VM broke new ground with a fully online consumer loan application solution, VM eLoan, powered by technology from Barbados-based fintech partner Carilend, in which VM holds a 30% equity stake.

An online pensions dashboard that enables customers to explore their portfolio through a portal and chat with representatives.

An expansion of VM money transfer services to allow clients to have remittances sent directly to their bank accounts.

An end-to-end online mortgage solution that provides customers with visibility into the status of their applications and typically cuts the time from application to pre-approval from months to days.

As Wedderburn-Reid highlights: “These are just some of the things that have been delivered to date in the five-year program, hinting of a lot more to come as it approaches its 2023 fruition. We’re now at the point where we’re highly focused on benefits realization,” says Wedderburn-Reid.

That value from the investments made thus far is already becoming evident — not just in customer scores but in the company’s bottom line.

In 2020, the Group reported a net surplus of J$2.64 billion (US$17.6m), up 24% and the best in its history. And in its core business of mortgages, it issued more than J$14.52 billion (US$96m) of loans, up 25%. There are other major factors at play for those numbers but, according to Courtney Campbell, digital transformation has already played a significant part.

Wedderburn-Reid also points to one key internal metric: VM’s semi-annual survey of employees that gauges their sentiment on how well they feel the digital transformation team is doing with respect to providing them with the tools, skills and understanding they need to execute their jobs effectively. “In year one we set a target score for ourselves of 70% and hit 68%. But by the second year we had surpassed that and by 2020 it had risen to 78%.”

But the measures will come when customers view VM’s omnichannel experience compelling. “Prior to our transformation journey, we recognized some customers felt they had a disjointed experience at our channels. We are well on the way to changing that to give them a comprehensive, seamless experience of the VM Group at each digital touchpoint. That is what we want VM to look and feel like by the end of 2023,” she says, “the result of us truly being digital.”

Watch Victoria Mutual’s Sheena Wedderburn-Reid explore the Seven pillars of success towards being digital’ as part of the Fujitsu CxO