Tokyo, October 05, 2018

Fujitsu has commenced development of "Fujitsu Banking as a Service" (FBaaS), a next-generation banking solution it aims to launch in 2020. The solution will be the first cloud service in Japan to provide a core digital banking system in "task units." Sony Bank Inc. has now started to consider the adoption of the solution as the first user.

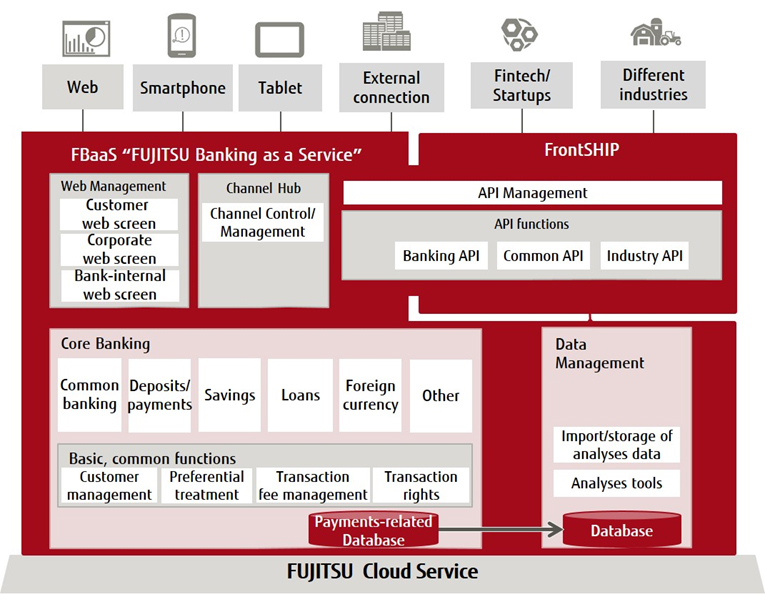

With FBaaS, previous settlement systems will be packaged as micro services(1) at the task level, such as for lending, fund management, loan services, and other operations. Optimized for the digital era, they will be offered as cloud services that can be flexibly coupled with each other on a cloud service platform. This works to minimize the scope of development and maintenance, establishing development efficiencies and stable operations, and results in flexible systems that are resilient to change.

Fujitsu will use FBaaS to support dramatic improvements in productivity and development speed when customers create new financial services. The company has plans to expand FBaaS into an ecosystem in which customers can sell the business systems they developed on their own to other customers, as cloud services.

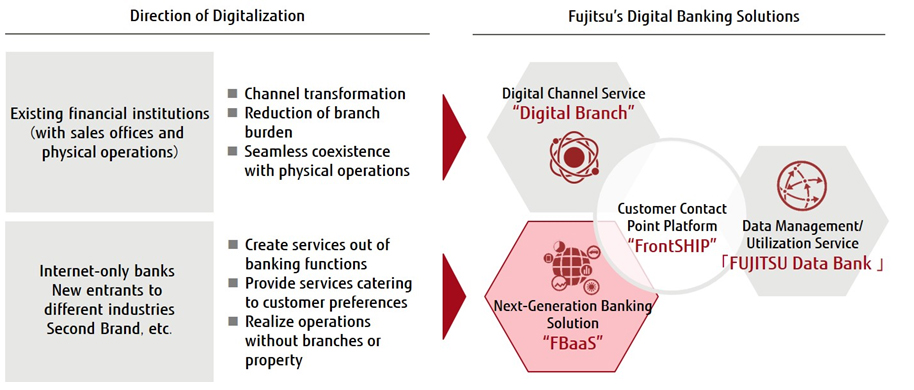

With the growth of fintech services in recent years, customer characteristics, delivery channels, and the players in financial services are seeing huge changes. Digital banking, in which financial operations are provided as services, has also begun to take off in Europe and North America. To capitalize on this shift, in March 2016 Fujitsu systemized its financial solutions as "Finplex." The company further systemized its digital banking solutions that support financial services into four lines: Finplex Customer Contact Point Platform FrontSHIP (FrontSHIP), which connects via APIs(2), Finplex Digital Channel Service Digital Branch (Digital Branch), which carries out banks' business processing on smartphones and tablets, Fujitsu Data Bank, which handles the management and utilization of personal data, and FBaaS, the next-generation banking solution. Fujitsu has already begun rollout of FrontSHIP and Digital Branch. Fujitsu plans to release Fujitsu Data Bank and FBaaS successively before the end of 2020, while Sony Bank is looking into becoming the first user of FBaaS.

Fujitsu Banking as a Service Overview

1. Dramatically boosts productivity and development speed customer creation of new financial services

FBaaS packages the core systems of digital banking as micro services in task units, such as deposits and payments, savings, and loans, and makes them available as cloud services. As each of the business systems can be flexibly joined on the cloud platform, the customer can select and combine their required cloud services to quickly and easily build a business system. Fujitsu is striving to dramatically increase productivity during the customer's creation of new financial services, and it has set the target of helping customers launch new financial services twice as quickly as before.

2. Creates an ecosystem that offers flexibility and expandability

As a cloud service, the banking solution provides core functions, such as customer management and deposits, settlements and others, as well as optional functions, including those dealing with foreign currency and loans. Customers can expand their system flexibly and with ease, according to need. Also, specific customer services can be developed rapidly, using agile development and DevOps(3), for flexible additions to the system. In the future, Fujitsu plans to grow FBaaS into an ecosystem where customers can sell their own business systems as cloud services to other customers.

3. Easily connects to external systems

By building the APIs into the service, it is device independent and reusability is increased. Also, by calling up service functions, it connects easily to external systems.

4. Realizes a safe and secure system

Micro servicing at the task level minimizes the scope of maintenance, which can raise system quality. Also, FBaaS is operated on Fujitsu Cloud Service, so the user can flexibly choose to run it from multiple datacenters, including those at sites outside Japan, which allows them to operate a secure, highly reliable disaster recovery environment(4) equipped with disaster countermeasures.

Future Plans

Fujitsu plans to launch FBaaS in 2020, initially offering it to internet-only banks and companies new to the market. The company will also provide mega banks and regional financial institutions with digital banking solutions, which will include FBaaS, to support the digital transformation of financial services and contribute to the creation of new financial services.

Sales Price

By quotation

Sales Target

Sales of JPY 100 billion for all of its digital banking solutions by the end of 2025