Tokyo, February 07, 2013

Fujitsu today announced that, for the third quarter of fiscal 2012, it recorded extraordinary losses stemming from restructuring expenses and other charges.

1. Consolidated Financial Results

(1) Recording of Extraordinary Losses

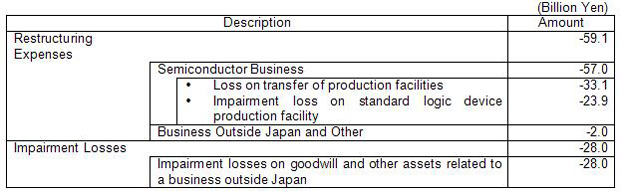

Major Items in Extraordinary Losses

① Restructuring Expenses for the Semiconductor Business

Stemming from the implementation of structural reforms to its semiconductor business, Fujitsu recorded 57.0 billion yen in restructuring expenses (consisting of a 33.1 billion yen loss on the transfer of production facilities and a 23.9 billion yen impairment loss on its production facility for standard devices). The loss on the transfer of production facilities consists of guarantees for operating costs in the Iwate Plant and the LSI assembly and testing facility that were transferred, personnel-related expenses arising from the transfer of the LSI assembly and testing facility, impairment losses, and other items. The impairment loss on the production facilities of standard logic devices, for which capacity utilization rates have been declining, such as the Mie Plant's 200mm line and the 200mm line located in the Aizu-Wakamatsu region.

Fujitsu's semiconductor business shifted to a "fab-lite" business model in 2009, when it decided to outsource the mass production of 40nm generation logic devices to Taiwan Semiconductor Manufacturing Company Limited (TSMC) and formed a partnership with TSMC in advanced process technology for 28nm generation devices and beyond. Due to rapid changes in the market, however, it has been facing an extraordinarily severe operating environment. As a result, Fujitsu has decided to restructure this business. Specifically, it is considering transferring the Mie Plant's 300mm line to a new foundry company that it is planning to establish with TSMC. It is also considering integrating its system LSI device business with that of Panasonic Corporation in a new fabless company they would establish with the equity participation of third-party investors. For further details, please refer to two announcements released today, "Fujitsu Announces Restructuring and New Direction of its Semiconductor Business," and "Fujitsu and Panasonic to Consolidate System LSI Businesses in New Company."

② Impairment Losses on Goodwill and Other Assets related to a Business outside Japan

Fujitsu recorded impairment losses of 28.0 billion yen as an extraordinary loss on the remaining unamortized balance of goodwill and other intangible assets recorded at the time it acquired Fujitsu Technology Solutions (Holding) B.V. (and its consolidated subsidiaries; FTS), a European subsidiary. As a result of the prolongation of the recession in Europe and the intensification of price competition in PCs and x86 servers, Fujitsu now anticipates that it will not be able to achieve its original plan, formulated in April 2009, at the time it acquired the remaining shares in FTS, of recouping its investment over a period of ten years.

In April 2009, Fujitsu converted FTS, which had been an equity-method affiliate, into a wholly owned subsidiary. Fujitsu then moved forward with the global expansion of its business in x86 servers and other hardware products. At the same time, to maximize the synergy between FTS and its UK subsidiary Fujitsu Services Holdings PLC (and its consolidated subsidiaries; FS), Fujitsu promoted the optimization of its resources in Europe through such measures as restructuring the operations of the FTS Group and the FS Group in respective regions of Europe.

Both before and after becoming a wholly owned subsidiary, FTS had implemented structural reforms, and it had consistently recorded operating profits until the previous fiscal year. Due to the recession in Europe, however, FTS's earnings environment has dramatically deteriorated, with price competition intensifying beyond levels that had been imagined at the time FTS was acquired, primarily in the hardware product business, and it is anticipated that FTS will record an operating loss for fiscal 2012. To improve FTS's earnings, a reduction in its workforce is being considered, and there are also plans to shift its structure from a business primarily focused on hardware products to one focused on services and solutions business, with the hardware products business at its base.

(2) Impact on Future Consolidated Financial Results

In the fourth quarter, as well, Fujitsu expects to record extraordinary losses of 83.0 billion yen on restructuring expenses, including for personnel-related expenses in and outside of Japan. For further details, please see Fujitsu's financial results for the third quarter of fiscal 2012, which were released today.

2. Unconsolidated Financial Results

(1) Recording of Extraordinary Losses

Major Items in Extraordinary Losses

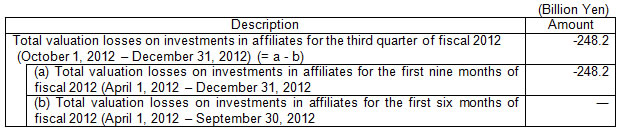

① Semiconductor Subsidiary: Fujitsu Semiconductor Limited

As a result of deterioration in its financial performance, Fujitsu recorded a valuation loss of 165.4 billion yen on the subsidiary's stock due to the value of the Company's net assets falling below 50% of the book value of Fujitsu's investment, and because the estimated value from the recovery of net assets within roughly a 5-year period is less than the book value of its investment.

② European Subsidiary: Fujitsu Technology Solutions (Holding) B.V.

As a result of deterioration in its financial performance, Fujitsu recorded a valuation loss of 82.4 billion yen on the subsidiary's stock due to the erosion of the Company's excess earnings generation capacity envisioned at the time of its acquisition, and because the estimated value from the recovery of net assets within roughly a 5-year period is less than the book value of its investment.

(2) Impact on Future Unconsolidated Financial Results

In the fourth quarter, as well, further structural reforms of the semiconductor business will be undertaken, leading to the possibility that further valuation losses on the shares of Fujitsu Semiconductor Limited will be generated.

Starting in fiscal 2013, the UK subsidiary Fujitsu Services Holdings PLC (FS) will adopt revised accounting standards for retirement benefits. It is expected that FS's net assets will decline because of recognition of the previously unrecognized retirement benefit obligations in net assets net of tax effects. After completing the pension actuarial calculations at the end of fiscal 2012, assuming the estimated value from the recovery of the subsidiary's net assets within roughly a 5-year period is less than the book value of Fujitsu's investment, Fujitsu is considering recording a valuation loss of approximately 100.0 billion yen on the subsidiary's stock at the end of fiscal 2012.

These materials may contain financial projections and other forward-looking statements that are based on information currently possessed by Fujitsu and certain views and assumptions that are considered to be reasonable. Actual results may differ materially from those projected or implied in the forward-looking statements due to a variety of factors.