Archived content

NOTE: this is an archived page and the content is likely to be out of date.

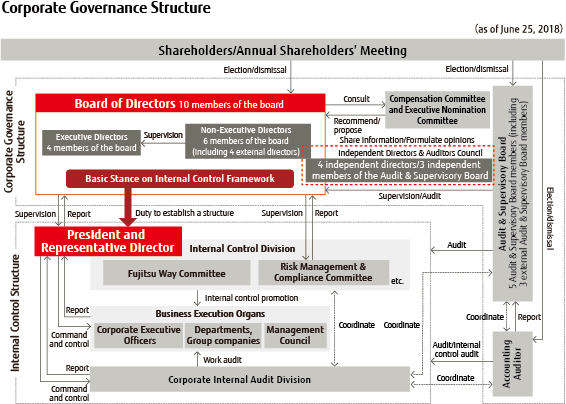

Corporate Governance

Basic Stance on Corporate Governance

As a resolution of the Board of Directors meeting held in December 2015, Fujitsu established the " Corporate Governance Policy'' to define the company's basic stance on corporate governanace. The policy set out a framework of Fujitsu's corporate governance structure as follows;

Structural framework

The company outlines the following rules to ensure the effective oversight and advice from a diverse perspective of Non-Executive Directors (hereinafter, the term used for the combination of Independent Directors and Non-Executive Directors appointed from within the company) to Executive Directors on their business execution as part of the Board of Directors function while taking advantage of the company with the Audit & Supervisory Board system:

- Same number or more Non-Executive Directors responsible for oversight are appointed as Executive Directors responsible for business execution.

- Independent Directors are appointed as the core members of Non-Executive Directors, and at least one Non-Executive Director is appointed from within the company.

- Independent Directors must meet the independence standards (hereinafter referred to as "Independence Standards") established by the company.

- In nominating Non-Executive Director candidates, the company takes account of the background of candidates and their insight on the company's business.

- The company has the Audit & Supervisory Board Members' external audit and oversight on the Board of Directors, the voluntary Executive Nomination Committee and Compensation Committee composed mainly of Non-Executive Directors and Auditors (hereinafter, the term used for the combination of Non-Executive Directors and Audit & Supervisory Board Members), and the Independent Directors & Auditors Council, all function to complement the Board of Directors.

- Independent Audit & Supervisory Board Members shall be the External Audit & Supervisory Board Members who meet the Independence Standards.

- Corporate Governance Policy and Independence Standards for External Directors & Auditors

http://pr.fujitsu.com/jp/ir/governance/governancereport-b-en.pdf

Overview of Corporate Governance Structure (as of June 25, 2018)

Overview of Board of Directors

The Company has a Board of Directors to serve as a body for making important decisions and overseeing management. The Board of Directors delegates the decision-making authority over business execution to the Representative Directors and subordinate Corporate Executive Officers to the broadest extent that is permitted by law and the Articles of Incorporation of the company and is considered to be reasonable and will mainly perform as oversight and advisory function. Moreover, the oversight function of the Board of Directors has been strengthened by actively appointing External Directors with high independence and diverse perspective.

Furthermore, in order to better define the management responsibility of the Directors, their terms were reduced from two years to one year in accordance with a resolution at the June 23, 2006 Annual Shareholders' Meeting.

The Board of Directors is comprised of 10 members in total: 4 Executive Directors and 6 Non-Executive Directors (including 4 External Directors and two of them are women).

Overview of the Audit & Supervisory Board

The Company has an Audit & Supervisory Board that performs the auditing and oversight functions. The auditing and oversight functions are carried out by Audit & Supervisory Board Members, who review the Board of Directors as well as business execution functions and attend important meetings, including meetings of the Board of Directors.

The Audit & Supervisory Board has five members, comprising two full-time Audit & Supervisory Board Members and three external Audit & Supervisory Board Members.

Executive Nomination Committee and Compensation Committee

The Company has established the Executive Nomination Committee and the Compensation Committee as advisory bodies for its Board of Directors to ensure the transparency and objectivity of its process for nominating Directors and Audit & Supervisory Board Members and its process for determining executive compensation as well as to ensure the fairness of the method and level of executive compensation.

The Executive Nomination Committee deliberates about candidates for Director and Audit & Supervisory Board Member positions in accordance with the Framework of Corporate Governance Structure and the Procedures and Policy of Directors and Auditors Nomination stipulated in the Company's Corporate Governance Policy and provides its recommendations to the Board of Directors. In addition, the Compensation Committee provides its recommendations about the level of base compensation and the method for calculating performance-based compensation to the Board of Directors in accordance with the Procedures and Policy of Determining Directors and Auditors Compensation stipulated in the Company's Corporate Governance Policy.

According to the Corporate Governance Policy, each committee is composed of a majority of Non-Executive Directors and Auditors with at least one Independent Director. In fiscal 2017, each committee consists of three Non-Executive Directors and Auditors (including two Independent Director) and one Executive Director.

Both Committee's members in fiscal 2017 are as follows.

Chairman of both Committees: Tatsuzumi Furukawa

Members of both Committees: Jun Yokota Masami Yamamoto, and Chiaki Mukai

After the selection of the above committee members in July 2017, the Executive Nomination Committee met 6 times by the end of fiscal 2017. The Executive Nomination Committee discussed the election of Representative Directors, the election of Directors, etc. and provided its recommendations to the Board of Directors. The Compensation Committee met in May 2018..

Independent Directors & Auditors Council

In response to the requirements of Japan’s Corporate Governance Code, which facilitates the activities of Independent Directors and Auditors, and in order to invigorate discussions on the medium- to long-term direction of the company at its Board of Directors Meetings, the Company believes it essential to establish a system enabling Independent Directors and Auditors, who maintain a certain degree of separation from the execution of business activities, to consistently gain a deeper understanding of the Company’s business. Based on this recognition, the Company established the Independent Directors and Auditors Council. In the Independent Directors and Auditors Council, members discuss the medium- to long-term direction of the company and share information and exchange viewpoints so that they can each formulate their own opinions.

In fiscal 2017, the Independent Directors and Auditors Council met 6 times. The members shared information and exchanged viewpoints on the Company’s management direction, human resources development, the scope of business of the Company and of the Fujitsu Group, etc. and the Council provided advice to the Board of Directors based on the knowledge of its members.

Reasons for Adoption of Current Corporate Governance System

We believe that both direct oversight to business execution by the Non-Executive Directors and the oversight by Audit & Supervisory Board Members that stays distant from the decision making and operation of business execution should work jointly to ensure highly effective oversight performance. The company adopts “the company with Audit & Supervisory Board system” that establishes the Audit & Supervisory Board, which is composed of the Audit & Supervisory Board Members appointed as an independent agent.

The Board of Directors comprises same number or more Non-Executive Directors as Executive Directors to ensure its capacity to correct faulty, insufficient, or excessive business executions. While External Directors should be the core of Non-Executive Directors on account of their high independence, at least one Non-Executive Director is appointed from within the company to complement the External Directors’ knowledge in the business fields and the corporate culture of the company so that the efficiency of oversight performance by the Non-Executive Directors are enhanced.

View larger image (331 KB)

Policy on the Determination of Executive Compensation

Compensation of Directors and Audit & Supervisory Board Members is determined in accordance with the Executive Compensation Policy below, which was determined by the Board of Directors following the recommendation by the Compensation Committee.

[Reference] Executive Compensation Policy

To secure exceptional human resources required to manage the Fujitsu Group as a global ICT company, and to further strengthen the link between its financial performance and shareholder value, while at the same time improving its transparency, Fujitsu establishes its Executive Compensation Policy as follows.

Executive compensation is comprised of the following: “Base Compensation,” specifically a fixed monthly salary in accordance with position and responsibilities; “Performance-based Stock Compensation,” which is a long-term incentive that emphasizes a connection to shareholder value; and “Bonuses” that are compensation linked to short-term business performance.

Basic Compensation

Base compensation is paid to all Directors and Audit & Supervisory Board Members. A fixed monthly amount shall be determined for each executive in accordance with the position and responsibilities of each executive.

Bonuses

- Bonuses shall be paid to Directors who carry out executive responsibilities. The amount of a bonus shall reflect business performance in the respective fiscal year.

- As a specific method for calculating a bonus, Fujitsu shall adopt an "On Target model" that uses consolidated revenue and consolidated operating profit as indices and the amount shall be determined in accordance with the degree of achievement of the performance targets for the respective fiscal year.

Performance-based Stock Compensation

- Performance-based stock compensation shall be granted to Directors who carry out executive responsibilities,in order to share the profit with shareholders and as an incentive to contribute to enhancement of medium- tolong-term performance.

- A base number of shares in accordance with respective rank, performance judging period (three years) and mid- to long-term performance targets in terms of consolidated sales revenue and consolidated operating profit, and coefficient according to performance achievement level vis-à-vis the mid- to long-term performance targets shall be set in advance. The number of shares to be allocated for each fiscal year shall be calculated by multiplying the base number of shares and the coefficient according to the performance achievement level, and the total number of shares calculated shall be allocated upon completion of the performance evaluation period.

In accordance with the resolution of the Annual Shareholders' Meeting, the total amount of Base Compensation and Bonuses (monetary compensation) for Directors shall not exceed 600 million yen per year, Performance-linked Compensation (non-monetary compensation) shall not exceed 300 million yen per year, and the total number of shares to be allocated shall not exceed 430,000 shares per year. The Base Compensation for Audit & Supervisory Board Members shall not exceed 150 million yen per year.

| Category | Basic Compensation | Bonuses | Performance-based Stock

Compensation |

|

|---|---|---|---|---|

| Management Oversight Portion | Business Execution Portion | |||

| Directors | ○ | - | - | - |

| Executive Directors | ○ | ○ | ○ | ○ |

| Audit & Supervisory Board Members | ○ | - | - | |

Basic Stance on Internal Control System

To continuously increase the corporate value of the Fujitsu Group, it is necessary to pursue management efficiency and control risks arising from business activities. Recognizing this, Fujitsu is working toward the practice and penetration of the FUJITSU Way, the basic principles behind the Fujitsu Group's conduct. At the same time, the Board of Directors has articulated the Policy on Internal Control Framework as systems and rules to pursue management efficiency and control the risks arising from the Company's business activities.

Overview of the Policy on the Internal Control System

The Policy on the Internal Control System sets forth internal structures of the Fujitsu Group, including the following.

Decision-making and Structure of Management Execution

By dividing the management execution authority of the President & Representative Director, who is the chief executive officer, among the corporate executive officers, and by establishing a Management Council to assist in the President and Representative Director's decision-making, the Company aims to enhance management effectiveness.

In addition, the framework makes clear that the President & Representative Director bears responsibility for the construction and operation of an internal control framework, and the Board of Directors shall fulfill its oversight responsibility by appropriately examining the operation of the internal control framework.

Risk Management System

The Company shall establish a Risk Management & Compliance Committee, and in addition to preparing systems to control the overall risk of financial losses of the Fujitsu Group, the Company shall also prepare systems for managing risks pertaining to defects and failures in products and services, as well as systems for managing contracted development projects, information security, and financial risk.

Compliance System

Primarily through the Risk & Management Compliance Committee, the Company shall promote the preparation of the internal rules, education, and oversight systems required for compliance with the Code of Conduct set forth by the FUJITSU Way, and also with laws and regulations concerning the business activities of the Fujitsu Group.

The Company shall also prepare management systems to ensure the appropriateness of financial reporting, as well as systems for information disclosure and internal auditing.

The Policy on the Internal Control System and the Overview of the Status of Operation of the System

http://www.fujitsu.com/global/Images/notice118b.pdf

Overview of the Status of Operation of the System to Ensure the Properness of Fujitsu Group Operations

- Systems to Ensure that Directors Carry Out Their Responsibilities Efficiently

The Company has Corporate Executive Officers who share business execution authority with the Representative Director and President, and the Corporate Executive Officers carry out decision-making and business execution in accordance with their responsibilities.

The Management Council meets three times a month, discusses important management execution and assists the Representative Director and President in decision-making. In addition, rules determining the scope of delegation of duties from Representative Directors to other executives and employees and other matters and various systems for approvals and reaching decisions are put in place and are operated so that efficient and proper management execution is ensured based on these rules and systems. - Risk Management System and Compliance System

The Company positions the risk management system and the compliance system at the heart of the “Policy on the Internal Control System” and has established the Risk Management & Compliance Committee(the “Committee” ), which supervises these systems globally and reports to the Board of Directors.

The Committee is chaired by the Representative Director and President and consists mainly of Executive Directors. The Committee meets periodically and determines policies for preventing risks in business operations from arising and for countermeasures for losses caused by risks that have arisen.

The chairman of the Committee has appointed a Chief Risk Compliance Officer (CRCO) who executes the Committee’s decisions.

Regarding compliance violations and risks in business operations, including information security, the Committee has established and operates a system that covers not only the Company but the Fujitsu Group and ensures reporting to the Committee in a timely manner. It also operates the internal reporting system.

The Company has appointed a Chief Information Security Officer (CISO) under the Committee and formulates and implements information security measures. In addition, the Company has established the Cyber Security Committee under the Committee. While ensuring security throughout the Fujitsu Group, the Company is working to ensure and enhance information security of customers through products and services that embody Fujitsu’s security practices.

In the course of operating the systems described above, besides reporting when risks have arisen, the Committee periodically reports the progress and results of its activities to the Board of Directors and is supervised..

Under the Risk Management & Compliance Committee, the Company has established compliance-related rules, which are adhered to worldwide. Moreover, the Global Business Standards, which provide guidance on how individual employees should apply the Fujitsu Way Code of Conduct in their actions and are available in 20 languages, are applied uniformly across the Fujitsu Group. Furthermore, the Company has established the Global Compliance Program to maintain and improve its global structure for legal compliance across the Fujitsu Group. In addition, various education programs and activities to raise awareness have been implemented.

As an initiative for information management during fiscal 2017, in January 2018 the Company applied to the Dutch Data Protection Authority (DPA) to obtain approval for its Binding Corporate Rules for Processors (BCR-P), which are common rules established across the Fujitsu Group related to the handling of personal data that customers have entrusted to Fujitsu for processing. This application is part of the Company’s effort to meet the legal requirements for the protection of personal data in Europe laid out in the General Data Protection Regulation (GDPR) of the EU. - System to Ensure Proper Financial Reporting

As for a system to ensure proper financial reporting, the Company has established the FUJITSU Way Committee. Under this committee chaired by the Representative Director and President and consisting of Executive Directors and some Corporate Executive Officers.

Under this committee’s direction, the responsible organization has established a system called “Eagle Innovation.” In accordance with the rules established by the Company based on the principles of the Practice Standards for Management Assessment and Audit concerning Internal Control Over Financial Reporting published by the Business Accounting Council, internal control over financial reporting throughout the Fujitsu Group is assessed. - System to Ensure the Properness of Fujitsu Group Operations

The risk management system, the compliance system, and the system for ensuring proper financial reporting cover the Fujitsu Group.

Especially for risk management and compliance systems, Regional Risk Management &Compliance Committees have been established for individual Regions, which are geographical executive divisions of the Fujitsu Group worldwide. These regional committees are positioned under the Risk Management & Compliance Committee to function so that the entire Fujitsu Group is covered.

In addition, as a part of a system to ensure the properness of Fujitsu Group operations, the Company has established the Rules for Delegation of Authority called “Global DoA” that determines authority for decision-making of important matters of Fujitsu Group companies (excluding certain subsidiaries) and the decision-making process. The Company has its Group companies comply with the Global DoA. In addition, Group companies are required to report on their operations to the Company. In this way, the Company has put in place systems for decision-making and reporting of important matters at the Group.

The status of operation of the internal control system centering on the above is periodically reported to the Board of Directors.

Corporate Governance Report (As of January 11, 2019)

http://www.fujitsu.com/global/documents/about/ir/library/governance/governancereport20190111-en.pdf