Archived content

NOTE: this is an archived page and the content is likely to be out of date.

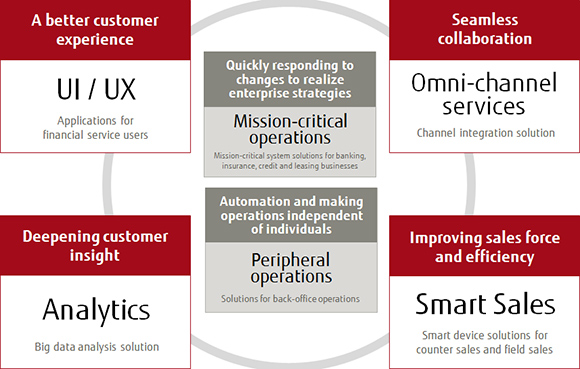

Financial solution concept

Accelerating the digital innovation, Co-creation with customers

Fujitsu announced the introduction of its new systematic approach to the financial solutions it offers through the FUJITSU Digital Business Platform MetaArc. The approach, known as "Finplex"(Note:1) will commence rolling out from today in the aim of future co-creation with its financial institution customers.

As one element of Finplex, Fujitsu will offer the APIs(Note:2) for finance-related services. These APIs will enable customers to create and quickly deploy new financial services.

Fujitsu has targeted the needs of financial institutions that offer financial services, mainly by providing solutions in the systems-of-record (SoR(Note:3)) area. Presently, Fujitsu, while maintaining the high levels of reliability of its SoR solutions, will offer solutions in the systems-of-engagement (SoE(Note:4)) area, responding to the needs of users of financial services. Furthermore, the company will help financial institutions create new value by creating connections with businesses using FUJITSU Knowledge Integration, which transcends the boundaries between businesses and sectors.

Fujitsu Financial solution, Finplex, can help customers with creating new value and providing innovative service to engage customer base all while navigating changes into business opportunities by its varied financial solution and business innovative idea to the industry.

Value of Finplex

Finplex features

Offers range of APIs

Finplex provides a variety of APIs for financial field businesses and services. Furthermore, customers can combine different APIs, and while quickly creating PoC (Note:5) and PoB (Note:6), can easily co-create innovative services, at low cost, in collaboration with fintech companies or companies in other industries.

Easy selection

Finplex is built on MetaArc to provide a SaaS, PaaS, and solutions packages. This makes it easy for customers to assemble combinations of solutions that meet their needs in terms of business goals, business plans, budgets, and product and service offerings at any particular time. With only minimal system development, business processes are faster and more efficient for the implementation of new services.

Hybrid operations

Customers are not obliged to implement their entire systems on MetaArc. They can also use hybrid operations that combine with their existing on-premise systems. So, for example, they could use their existing on-premise system for SoR operations, with their SoE operations running with Finplex on MetaArc. These two connect seamlessly for efficient, integrated operations.

Finplex towards the future

Fujitsu Financial solution, Finplex, will stay the same as always, to remain our high-end support to our current information system field (SoR). We also strive to provide a new value beyond the industry's expectation through business digital innovative services (SoE). Based on the today's technology to realize "half step ahead, futuristic business story" as the main key, we present our futuristic vision to the industry.

Notes

(Note:1) Finplex:Combining the words Finance and Complex to represent the idea of providing combinations of financial solutions.

(Note:2) API:Application Program Interface. A set of rules that define procedures and data formats that allow other programs to call functions and data managed by a given computer program.

(Note:3) SoR:Systems of Record. Existing systems that record company data and perform business processes.

(Note:4) SoE:Systems of Engagement. Systems that implement digital transformations, including business-process transformation and new-business development.

(Note:5) PoC:Proof of Concept. New technology and concept have the potential of being used.

(Note:6) PoB:Proof of Business. New business ideas and business have the potential of being used.